Unlock the Future: Top Cloud-Based LLM Trading Strategies for Success

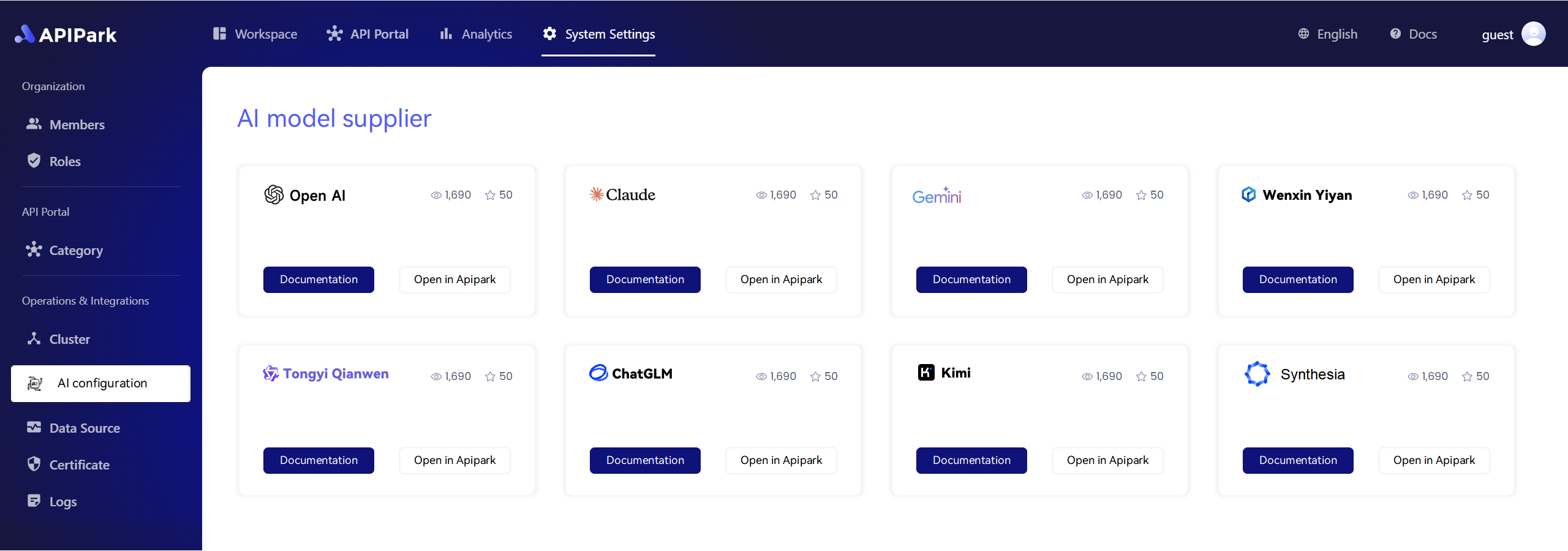

Open-Source AI Gateway & Developer Portal

In the rapidly evolving world of finance, leveraging advanced technologies like Cloud-Based Large Language Models (LLM) has become crucial for trading success. This article delves into the top cloud-based LLM trading strategies that can give you an edge in the market. We will explore how these strategies work, their benefits, and how APIPark can help you implement them efficiently.

Introduction to Cloud-Based LLM Trading Strategies

Cloud-Based LLM trading strategies utilize large language models hosted on the cloud to analyze market trends, predict price movements, and make informed trading decisions. These models can process vast amounts of data, identify patterns, and adapt to changing market conditions in real-time.

Why Cloud-Based LLMs?

Scalability: Cloud-based solutions can scale up or down quickly to meet the demands of different trading volumes.

Accessibility: With cloud-based models, traders can access their trading tools from anywhere, at any time, using any device.

Cost-Effectiveness: Cloud services often operate on a pay-as-you-go model, reducing upfront costs.

Top Cloud-Based LLM Trading Strategies

1. Sentiment Analysis

Sentiment analysis involves using natural language processing (NLP) to determine the sentiment of a text, whether it is positive, negative, or neutral. This can be particularly useful in analyzing social media data, news articles, and other sources of public opinion to predict market movements.

How it Works: LLMs analyze text data to determine the overall sentiment and identify potential market trends.

Benefits: - Provides insights into market sentiment in real-time. - Helps in identifying potential market opportunities or risks.

2. News Aggregation and Analysis

News aggregation involves collecting and analyzing news articles, press releases, and other forms of information to identify potential market-moving events.

How it Works: LLMs aggregate news from various sources and analyze it to identify trends and sentiment.

Benefits: - Keeps traders informed about market-moving events. - Helps in making informed trading decisions based on real-time news analysis.

3. Market Forecasting

Market forecasting uses historical data and current market conditions to predict future market movements.

How it Works: LLMs analyze historical data, market trends, and economic indicators to forecast future market movements.

Benefits: - Provides insights into potential market movements. - Helps in making informed trading decisions based on forecasts.

4. High-Frequency Trading (HFT)

High-frequency trading involves executing trades at extremely high speeds to take advantage of small price discrepancies.

How it Works: LLMs process and analyze vast amounts of data in real-time to execute trades at high speeds.

Benefits: - Takes advantage of small price discrepancies. - Executes trades faster than human traders.

5. Algorithmic Trading

Algorithmic trading uses mathematical models and rules to make trading decisions automatically.

How it Works: LLMs generate trading algorithms based on historical data and market trends.

Benefits: - Reduces human error. - Consistently executes trades based on predefined rules.

APIPark is a high-performance AI gateway that allows you to securely access the most comprehensive LLM APIs globally on the APIPark platform, including OpenAI, Anthropic, Mistral, Llama2, Google Gemini, and more.Try APIPark now! 👇👇👇

Implementing Cloud-Based LLM Trading Strategies with APIPark

Implementing cloud-based LLM trading strategies can be challenging, especially when it comes to managing the integration and deployment of these models. This is where APIPark comes into play.

How APIPark Can Help

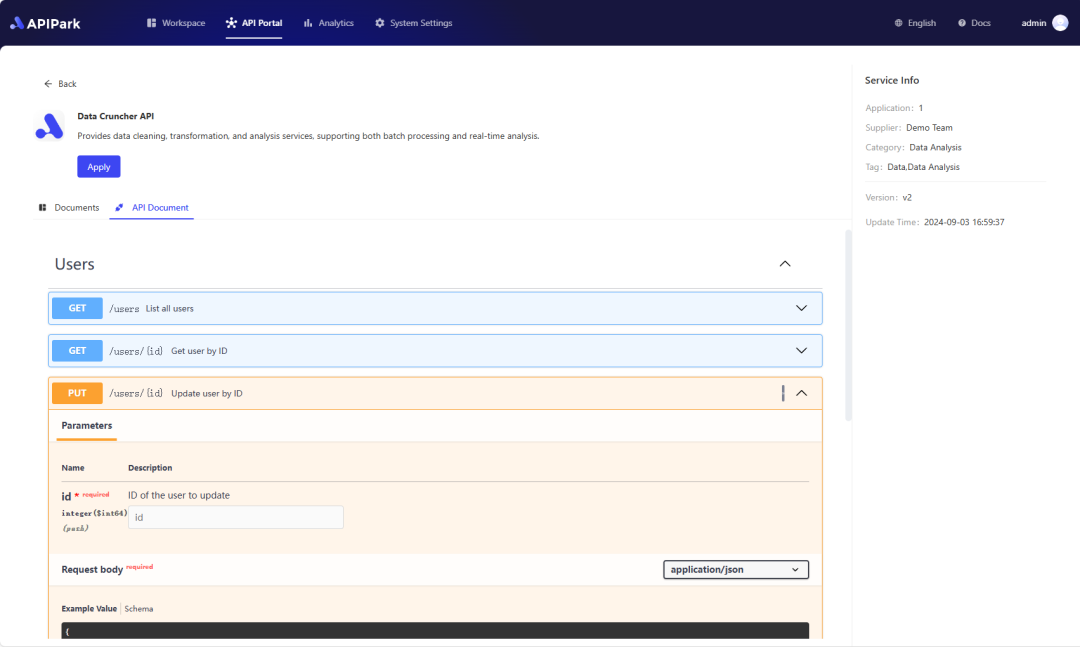

APIPark is an open-source AI gateway and API management platform designed to help developers and enterprises manage, integrate, and deploy AI and REST services with ease. Here’s how APIPark can assist you in implementing cloud-based LLM trading strategies:

| Feature | Description |

|---|---|

| Quick Integration of 100+ AI Models | APIPark offers the capability to integrate a variety of AI models with a unified management system for authentication and cost tracking. |

| Unified API Format for AI Invocation | It standardizes the request data format across all AI models, ensuring that changes in AI models or prompts do not affect the application or microservices. |

| Prompt Encapsulation into REST API | Users can quickly combine AI models with custom prompts to create new APIs, such as sentiment analysis, translation, or data analysis APIs. |

| End-to-End API Lifecycle Management | APIPark assists with managing the entire lifecycle of APIs, including design, publication, invocation, and decommission. |

| API Service Sharing within Teams | The platform allows for the centralized display of all API services, making it easy for different departments and teams to find and use the required API services. |

By using APIPark, you can streamline the implementation of cloud-based LLM trading strategies, ensuring that your trading operations run smoothly and efficiently.

Conclusion

Cloud-based LLM trading strategies offer traders a powerful tool to gain an edge in the market. By leveraging advanced technologies like APIPark, traders can implement these strategies with ease and efficiency. As the financial industry continues to evolve, staying ahead of the curve with innovative trading strategies and tools like APIPark will be key to achieving success.

FAQs

🚀You can securely and efficiently call the OpenAI API on APIPark in just two steps:

Step 1: Deploy the APIPark AI gateway in 5 minutes.

APIPark is developed based on Golang, offering strong product performance and low development and maintenance costs. You can deploy APIPark with a single command line.

curl -sSO https://download.apipark.com/install/quick-start.sh; bash quick-start.sh

In my experience, you can see the successful deployment interface within 5 to 10 minutes. Then, you can log in to APIPark using your account.

Step 2: Call the OpenAI API.