In the realm of financial analysis, understanding the significance of various methodologies and approaches can make a difference between success and failure. One such approach is the -3 method, which finds relevance primarily in the context of risk assessment and optimization. This article will explore the concept of -3, its implications in financial analysis, and a real-life example that showcases its application. Additionally, we will touch upon how AI security, Tyk, gateways, and traffic control can play essential roles in facilitating financial analysis processes.

What is the -3 Method?

The term -3 signifies a model or strategy that involves negative three standard deviations in a statistical distribution. In financial terms, it helps analysts gauge the potential risk or loss in their investments. Understanding this model is crucial for risk-averse investors who aim to mitigate losses while maximizing profits.

Moreover, the -3 concept is often utilized to identify outlier transactions or irregularities in financial data. By examining transactions that lie beyond -3 standard deviations, analysts can identify potential fraud, errors, or opportunities for more lucrative investments.

Key Applications of -3 in Financial Analysis

- Risk Management: The -3 method is vital for understanding the tail risks in investment portfolios.

- Performance Evaluation: Investors leverage this framework to benchmark the performance of various assets in their portfolio.

- Fraud Detection: The method assists in identifying irregularities in transaction data to pinpoint fraudulent activities.

Understanding the Statistical Background

In statistics, the normal distribution is a foundational aspect that analysts rely on. The mean and standard deviation are two core components of this distribution. The mean represents the average value, while the standard deviation quantifies the dispersion of data points relative to the mean.

The area beyond -3 standard deviations generally captures less than 0.3% of the distribution. Therefore, applying this in a financial context allows analysts to focus on an extremely thin segment of high-risk transactions or investments.

Algorithm to Implement the -3 Method

If you’re considering implementing the -3 method in your analysis, here’s a simple Python code snippet that demonstrates how to calculate and evaluate possible outliers based on the -3 standard deviation criterion:

import numpy as np

import pandas as pd

# Sample financial data

data = {

'transaction_value': [100, 102, 98, 101, 1000, 99, 101, 95, 97, 105]

}

df = pd.DataFrame(data)

# Calculate mean and standard deviation

mean = np.mean(df['transaction_value'])

std_dev = np.std(df['transaction_value'])

# Calculate -3 standard deviations

threshold = mean - 3 * std_dev

# Identify outliers

outliers = df[df['transaction_value'] < threshold]

print("Mean:", mean)

print("Standard Deviation:", std_dev)

print("Outliers below -3 standard deviations:\n", outliers)

Table: Performance Metrics Evaluated Using -3 Method

| Metric | Value | Interpretation |

|---|---|---|

| Mean Transaction Value | $101.0 | Average value of transactions |

| Standard Deviation | $2.96 | Variation in transaction values |

| -3 SD Threshold | $91.12 | Value below which potential fraud |

| Total Outliers | 1 | Indicates presence of suspect data |

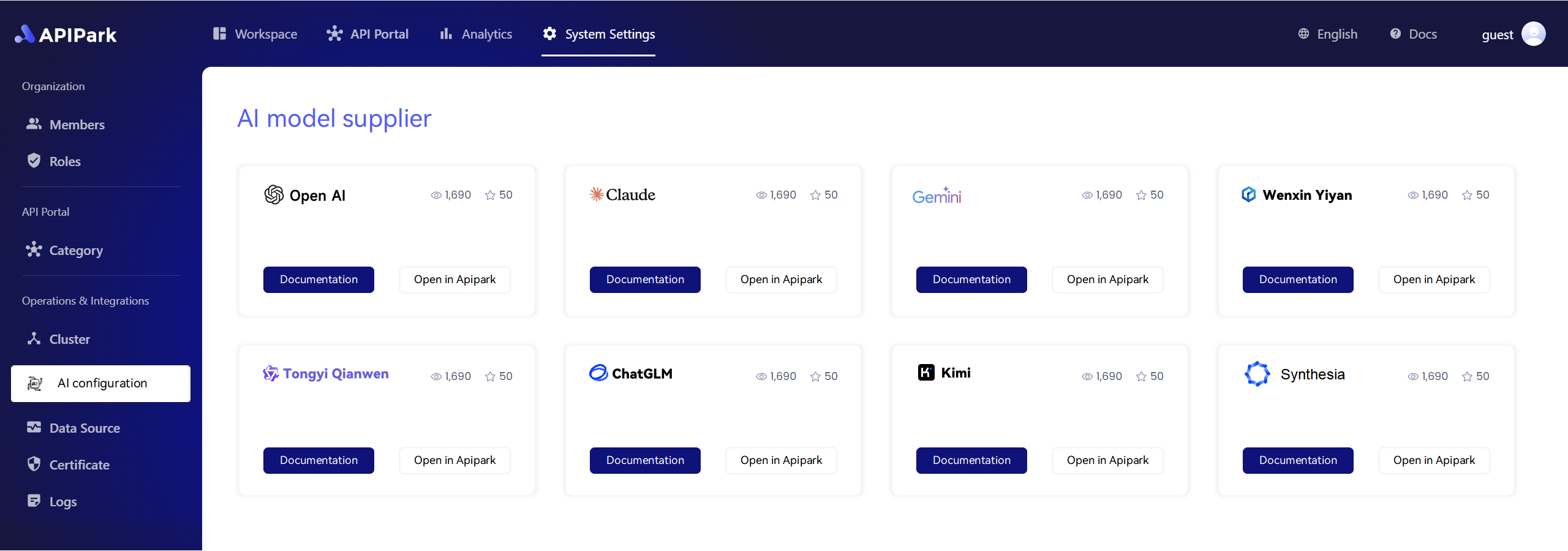

APIPark is a high-performance AI gateway that allows you to securely access the most comprehensive LLM APIs globally on the APIPark platform, including OpenAI, Anthropic, Mistral, Llama2, Google Gemini, and more.Try APIPark now! 👇👇👇

Real-Life Example: Application of the -3 Method in Financial Analysis

Now that we’ve established the theoretical background of the -3 method, let’s explore a practical scenario in which financial analysts applied this model to identify irregular transactions.

The Case of a Financial Institution

A significant financial institution sought to optimize its transaction monitoring system to detect incidences of fraud. With thousands of transaction entries processed daily, discovering patterns or inconsistencies was paramount. By leveraging the -3 statistical model, the institution implemented the following strategy:

- Data Compilation: Extensive transactional data was collected and organized for analysis.

- Statistical Analysis: The mean transaction values and standard deviations were calculated using the -3 criteria.

- Outlier Detection: Transactions falling below -3 standard deviations were flagged for further investigation.

- Decision Making: Fraudulent transactions were isolated, allowing for quick response and mitigation.

The outcome was significant; the institution identified a pattern that could easily be overlooked and subsequently prevented substantial financial losses.

Integrating AI and Security in Financial Analysis Processes

The implementation of the -3 method has become more efficient with the integration of AI technologies in financial analysis. AI algorithms can rapidly analyze large datasets, apply statistical models, and uncover insights much faster than traditional methods.

Importance of AI Security

AI security plays a crucial role in protecting sensitive financial data during the analysis process. Using secure APIs, institutions can manage their data access effectively. By leveraging platforms like Tyk and ensuring efficient gateway management, organizations can enhance their security protocols while still harnessing the power of AI.

Role of Tyk and Gateway in Financial Analysis

Tyk, an open-source API gateway, simplifies API management for organizations, including those in the financial sector. It’s particularly beneficial for managing traffic control effectively, allowing institutions to regulate how their APIs are accessed. With intelligent traffic control mechanisms, businesses can prioritize specific endpoints, manage API rate limits, and enable seamless integration of the -3 method with various financial analysis tools.

For example, Tyk could enable real-time monitoring of transaction APIs, ensuring that they are only accessed by authenticated users, thereby mitigating risks of unauthorized access and fraud.

Traffic Control in Action

Traffic control can prevent flood attacks on an API that processes large volumes of transactions. By controlling the flow of data to API endpoints, organizations can maintain system performance and availability, ultimately improving the efficiency of financial analysis operations.

Conclusion

Understanding the -3 method provides invaluable insight into financial analysis, especially when dealing with large datasets. While statistical approaches like this are essential for risk management and fraud detection, the permanence of AI security and integration platforms such as Tyk significantly enhances the overall performance and reliability of financial analysis systems.

The combinations of these elements—the theoretical basis of the -3 method, real-life performances, AI capabilities, and efficient traffic control—can lead financial analysts to make informed decisions, thereby safeguarding their investments and enhancing organizational performance ultimately. By embracing these technologies and methodologies, organizations can stay ahead of potential risks, ensuring a more stable financial future.

The journey to understanding the intricate relationship of these concepts centers on continuous learning and adaptation. As technology evolves, so too will the strategies and tools that financial analysts employ, making it imperative to remain vigilant and knowledgeable in this ever-changing landscape.

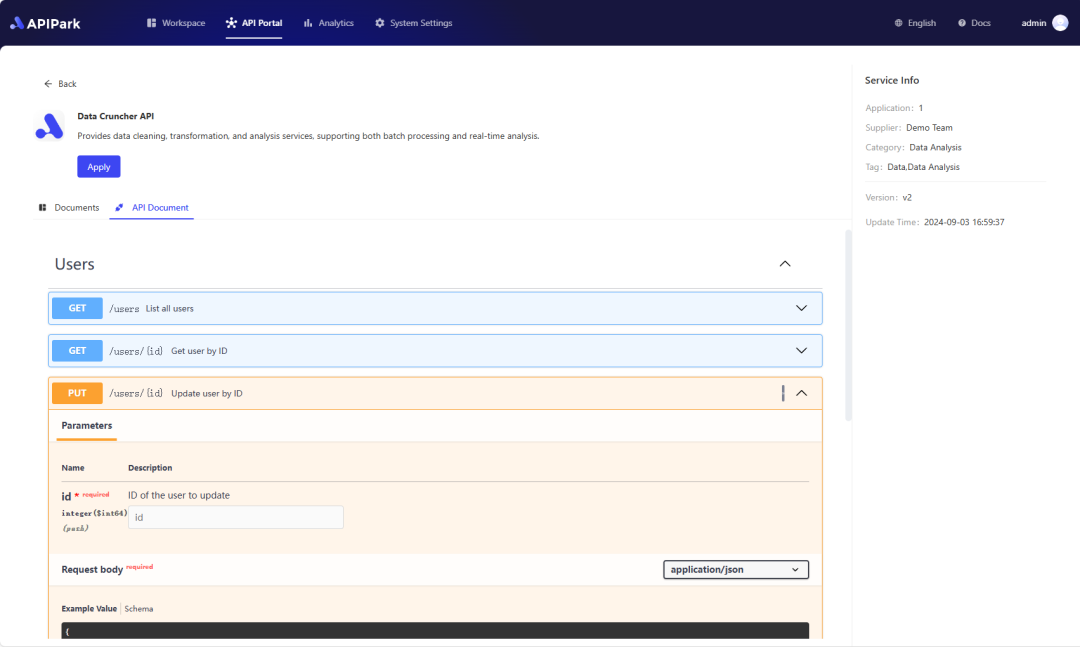

🚀You can securely and efficiently call the Claude API on APIPark in just two steps:

Step 1: Deploy the APIPark AI gateway in 5 minutes.

APIPark is developed based on Golang, offering strong product performance and low development and maintenance costs. You can deploy APIPark with a single command line.

curl -sSO https://download.apipark.com/install/quick-start.sh; bash quick-start.sh

In my experience, you can see the successful deployment interface within 5 to 10 minutes. Then, you can log in to APIPark using your account.

Step 2: Call the Claude API.