Introduction

In the rapidly evolving landscape of the insurance industry, operational efficiency and effective production processes play a pivotal role in determining a company’s success. Production operations encompass various functions that range from policy issuance to claims processing, ensuring that an insurance company meets customer expectations while maintaining profitability. This article delves into the multifaceted role of production operations within an insurance company, exploring the significance of innovative tools such as APIPark, tyk, and OpenAPI, along with concepts like API Cost Accounting. Additionally, we will address the question: What does production operations in an insurance company do?

The Landscape of Insurance Production Operations

Operations in an insurance company are the backbone that supports customer interactions and internal workflows. The production operations team handles:

- Policy Issuance: Streamlining the creation of insurance policies, ensuring accuracy in documentation and compliance with regulations.

- Claims Management: Efficiently managing and processing claims to provide timely reimbursements and maintain customer satisfaction.

- Risk Assessment: Collaborating with underwriters to evaluate risks associated with potential clients, aiding in appropriate policy pricing.

- Customer Service: Handling inquiries and service requests to maintain a positive relationship between the client and the insurer.

These operations require seamless integration with technology solutions, ensuring that workflows are automated and errors minimized.

The Role of Technology in Enhancing Production Operations

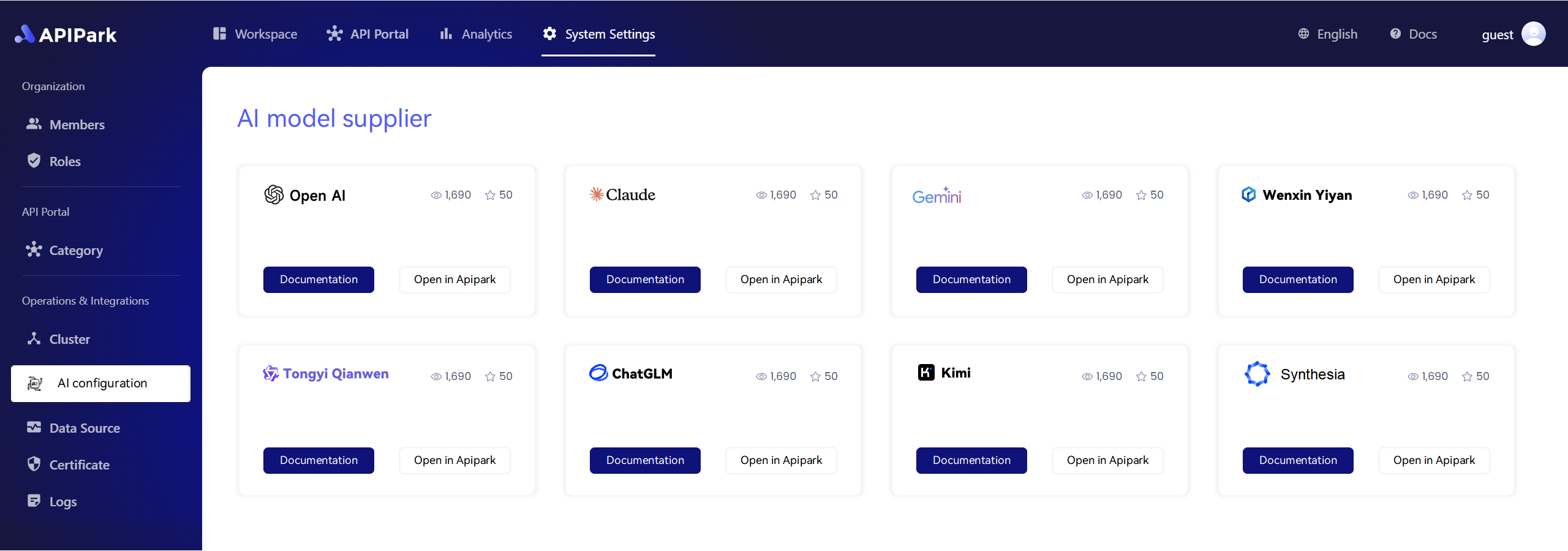

APIPark: Centralized API Management

One of the key players in modernizing production operations within an insurance context is APIPark. This platform serves as a centralized API management tool, enabling companies to streamline their API services. Here are some of the key features of APIPark relevant to production operations:

- API Service Centralized Management: Helps in mitigating issues related to the scattered nature of APIs across departments. This is crucial for cross-department collaborations, improving efficiency.

- Lifecycle Management: Covers the entire lifespan of an API from design to retirement. This feature allows insurance companies to maintain quality and support innovations continually.

- Multi-Tenant Management: Facilitates independent management of various teams within the company, ensuring data security while boosting administrative efficiency.

- API Resource Approval: Ensures that the API consumption process is compliant, adding another layer of security.

Tyk and OpenAPI: Bridging the Gap

Tyk is another robust solution that works in conjunction with OpenAPI specifications. For insurance companies, these tools open new avenues for managing operations effectively. Utilizing Tyk allows teams to leverage features like:

- API Gateway: Acts as a gatekeeper to secure and manage traffic between users and services.

- Detailed Analytics: Tracking API usage patterns provides insights into operational efficiency.

- Performance Management: Helps identify performance bottlenecks, enabling swift resolutions.

The integration of OpenAPI with systems like Tyk allows for standardized API documentation which leads to clearer communication both internally among operation teams and externally with clients.

API Cost Accounting:Tracking Efficiencies

Understanding the costs associated with different API calls can significantly enhance decision-making processes. API Cost Accounting enables insurance companies to:

- Identify Cost Drivers: By analyzing API usage patterns, businesses can determine which operations are more resource-intensive.

- Optimize Operations: Knowing where resources are being allocated helps in refining processes to reduce costs.

- Enhance Budgeting: With precise calculations of API costs, organizations can allocate budgets more effectively.

A well-structured API Cost Accounting framework can help production operations cut down extraneous expenses, ensuring that resources are used efficiently.

The Interplay of Production Operations and Customer Experience

Customer Interaction

In the realm of insurance, customer interaction is critical. The production operations team must ensure that various touchpoints are optimized for a seamless customer experience. This includes:

- Quick Onboarding Processes: Streamlining the policy issuance process to ensure that clients receive their documentation promptly.

- Efficient Claims Processing: Developing clear protocols to handle claims swiftly can significantly impact customer satisfaction.

- Ongoing Communication: Effective communication channels should be established to keep clients informed of their policy and claims status.

Data Management

Data management systems must be in place to ensure accurate record-keeping and easy retrieval of information. By employing tools like APIPark for API management, insurance companies can create an integrated digital framework that supports data-driven decision-making.

APIPark is a high-performance AI gateway that allows you to securely access the most comprehensive LLM APIs globally on the APIPark platform, including OpenAI, Anthropic, Mistral, Llama2, Google Gemini, and more.Try APIPark now! 👇👇👇

Challenges Faced in Production Operations

Despite the advancements in technology, insurance companies still face a variety of challenges within their production operations:

- Regulatory Compliance: Keeping up with ever-changing regulations can be daunting for operations teams.

- Data Security: With increasing cyber threats, ensuring data integrity and security remains a top priority.

- Operational Silos: Disparate systems can lead to inefficiencies, as information may not flow freely between departments.

Mitigating these challenges requires a strategic approach coupled with the right technological tools.

Case Study: Implementing APIPark in Production Operations

To illustrate the impact of optimized production operations, let us look at a case study of an insurance company that implemented APIPark to improve its production processes. The company faced challenges in maintaining API services effectively due to siloed operations. After deploying APIPark, the company observed the following benefits:

| Feature | Before APIPark | After APIPark |

|---|---|---|

| API Management | Scattered and manual | Centralized and automated |

| Claims Processing Time | 8 days average | 3 days average |

| Customer Satisfaction Rating | 70% | 90% |

| Compliance Management | Manual checks | Automated approval workflows |

The above table showcases the measurable improvements that followed the integration of APIPark into their production operations. Reducing claims processing time contributed to a significant increase in customer satisfaction, proving that operational efficiency directly impacts the bottom line.

Conclusion

In conclusion, understanding the role of production operations in an insurance company is essential for enhancing efficiency and customer service. Tools like APIPark, Tyk, and OpenAPI present innovative solutions for API management, while concepts like API Cost Accounting enable informed decision-making. By embracing a technology-forward approach and aligning operations with customer needs, insurance companies can navigate the complexities of the industry and thrive in a competitive market. Ultimately, the question – What does production operations in an insurance company do? can be answered as operations that facilitate seamless delivery of insurance services while fostering innovation and compliance. The integration of these facets ensures a robust operational framework that supports sustainable growth and customer satisfaction in the insurance sector.

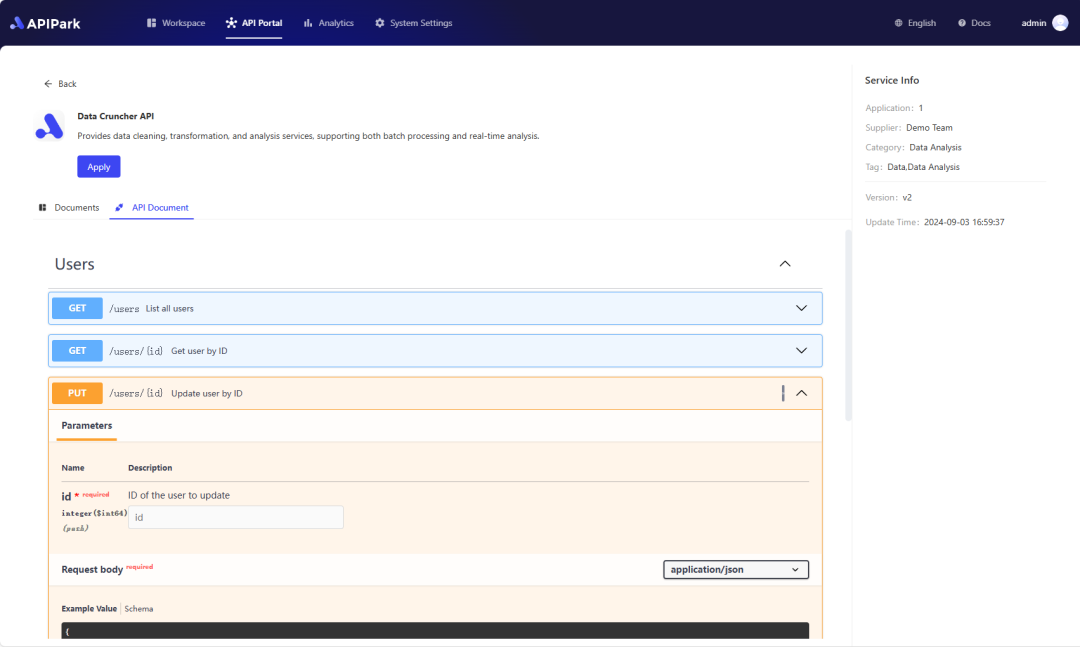

🚀You can securely and efficiently call the Claude(anthropic) API on APIPark in just two steps:

Step 1: Deploy the APIPark AI gateway in 5 minutes.

APIPark is developed based on Golang, offering strong product performance and low development and maintenance costs. You can deploy APIPark with a single command line.

curl -sSO https://download.apipark.com/install/quick-start.sh; bash quick-start.sh

In my experience, you can see the successful deployment interface within 5 to 10 minutes. Then, you can log in to APIPark using your account.

Step 2: Call the Claude(anthropic) API.