Crum and Forster is a century-old name in the insurance industry, recognized for its diverse solutions tailored to meet the needs of various clients. Over the years, the company has adapted to changing market landscapes, technological advancements, and evolving consumer expectations. In this comprehensive guide, we will explore Crum and Forster’s insurance services, focus on their innovative use of technology to enhance customer experience, and emphasize the importance of security protocols like API security in facilitating these services.

Overview of Crum and Forster

Founded in 1822, Crum and Forster is known for offering various insurance products, including property, casualty, and specialty lines. They operate under a unique business model that focuses on delivering value-added services specific to their clients’ needs, be they individuals or businesses.

Key Insurance Services Offered by Crum and Forster

-

Property Insurance:

Property insurance solutions are crucial for businesses looking to protect their physical assets against risks such as fire, theft, or natural disasters. Crum and Forster provides a comprehensive array of property insurance options that cater to industries such as manufacturing, retail, and construction. -

Casualty Insurance:

Casualty insurance covers various liability issues that businesses may face. It helps protect assets and provides legal defense against claims from third parties. Crum and Forster offers tailored casualty insurance products for various sectors, ensuring specific risks are addressed. -

Specialty Insurance:

For businesses with unique insurance needs, Crum and Forster provides specialty insurance products that cater to sectors like hospitality, technology, and transportation. These products often require customized solutions and are crucial for managing niche risks. -

Workers’ Compensation:

Protecting employees is central to a fruitful business operation. Crum and Forster’s workers’ compensation insurance helps businesses fulfill their legal obligations while ensuring that employees receive the support they need in case of work-related injuries. -

Excess and Surplus Lines:

Crum and Forster excels in providing excess and surplus lines insurance, catering to specialized risks that standard insurance cannot cover. This flexibility positions them as a reliable partner for high-risk industries.

The Role of Technology in Enhancing Insurance Services

As the insurance landscape evolves, technology plays a critical role in improving efficiency and customer engagement. Crum and Forster is at the forefront of integrating technology into their services, leveraging digital tools to streamline processes and enhance client experience.

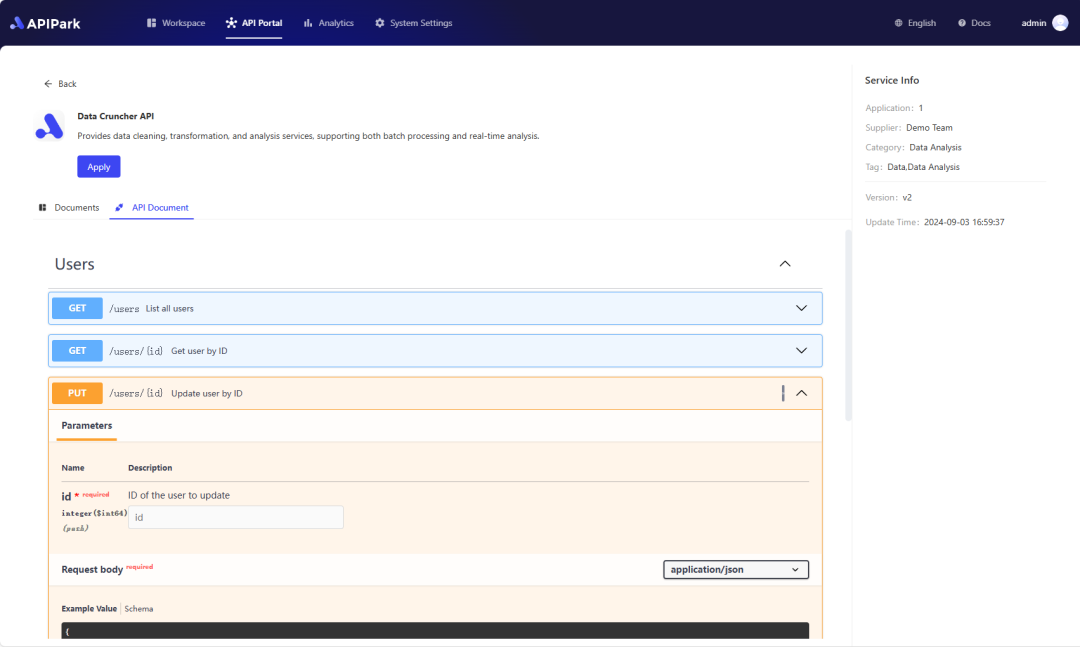

API Integration and Open Platforms

In the age of digital transformation, the integration of APIs has become essential for insurers. Crum and Forster utilizes Open Platforms that enable APIs (Application Programming Interfaces) to connect various services seamlessly. This allows for the sharing and utilization of data across multiple applications, thereby improving service delivery.

Understanding API Security

The integration of APIs, while beneficial, also raises concerns regarding data security. With the increasing reliance on digital solutions, ensuring API security is paramount for protecting sensitive information. Crum and Forster employs a range of measures to ensure the security of their API connections, such as:

-

Basic Auth: A simple form of API authentication where the client sends HTTP requests that include credentials (username and password) encoded in Base64.

-

AKSK (Access Key Secret Key): This security mechanism uses paired keys to authenticate requests to the API, ensuring that only authorized users can access services.

-

JWT (JSON Web Tokens): JWT provides a compact and self-contained way to transmit information securely between parties, allowing verification of the sender’s identity and integrity of the message.

Improved Customer Experiences

By leveraging API integration, Crum and Forster enhances the overall customer experience across various touchpoints. The following are some of the ways they optimize client interactions:

-

Streamlined Claims Processing: The use of API platforms facilitates rapid communication and data exchange, reducing the claims processing time significantly.

-

Instant Quotes and Underwriting: Clients can receive instant insurance quotes based on their specific needs, thanks to automated underwriting processes enabled by API connections.

-

Real-time Policy Management: Customers can manage their policies through user-friendly portals that provide real-time updates, policy adjustments, and claims tracking.

Customer Support and Resources

Crum and Forster places great importance on customer support, ensuring clients have access to resources and assistance whenever needed. Their support framework includes:

- A dedicated customer service team available to address queries related to policy management, claims processing, and more.

- Detailed resources available on their website, such as information on coverage options, claims process guidelines, and FAQs.

- Online portals that allow customers to access their policy information, file claims, and communicate with support staff.

Exploring the Future of Crum and Forster’s Insurance Services

As Crum and Forster continues to evolve with the changing market dynamics, their commitment to providing innovative insurance solutions remains steadfast. The incorporation of technology and prioritization of API security will play a vital role in their ongoing success.

One thing is clear: by embracing new technologies, Crum and Forster not only seeks to protect their clients but also to empower them with the knowledge and resources necessary to navigate the complex insurance landscape.

Conclusion

In summary, Crum and Forster exemplifies a forward-thinking insurance provider that leverages technology to enhance its offerings and streamline processes for a better customer experience. Through API integration, the company ensures that it addresses various risks while prioritizing security through Basic Auth, AKSK, and JWT. As they continue to adapt and innovate in this evolving landscape, clients can enjoy comprehensive, reliable insurance solutions.

Table: Comparison of Security Mechanisms

| Security Mechanism | Description | Use Case |

|---|---|---|

| Basic Auth | Simple authentication using username and password encoded in Base64 | Basic API connections |

| AKSK | Access Key and Secret Key combination provides secure API access | High-security APIs |

| JWT | Token-based authentication that transmits information securely and is self-contained | Real-time applications requiring secure data transmission |

Code Example

Here is an example of making an authenticated API request to the Crum and Forster service using JWT in a JSON format. This snippet demonstrates how to call an API endpoint securely.

curl --location 'http://api.crumandforster.com/v1/quotes' \

--header 'Content-Type: application/json' \

--header 'Authorization: Bearer YOUR_JWT_TOKEN' \

--data '{

"coverageType": "property",

"value": 1000000

}'

Make sure to replace YOUR_JWT_TOKEN with your actual token and modify the endpoint according to your specific needs.

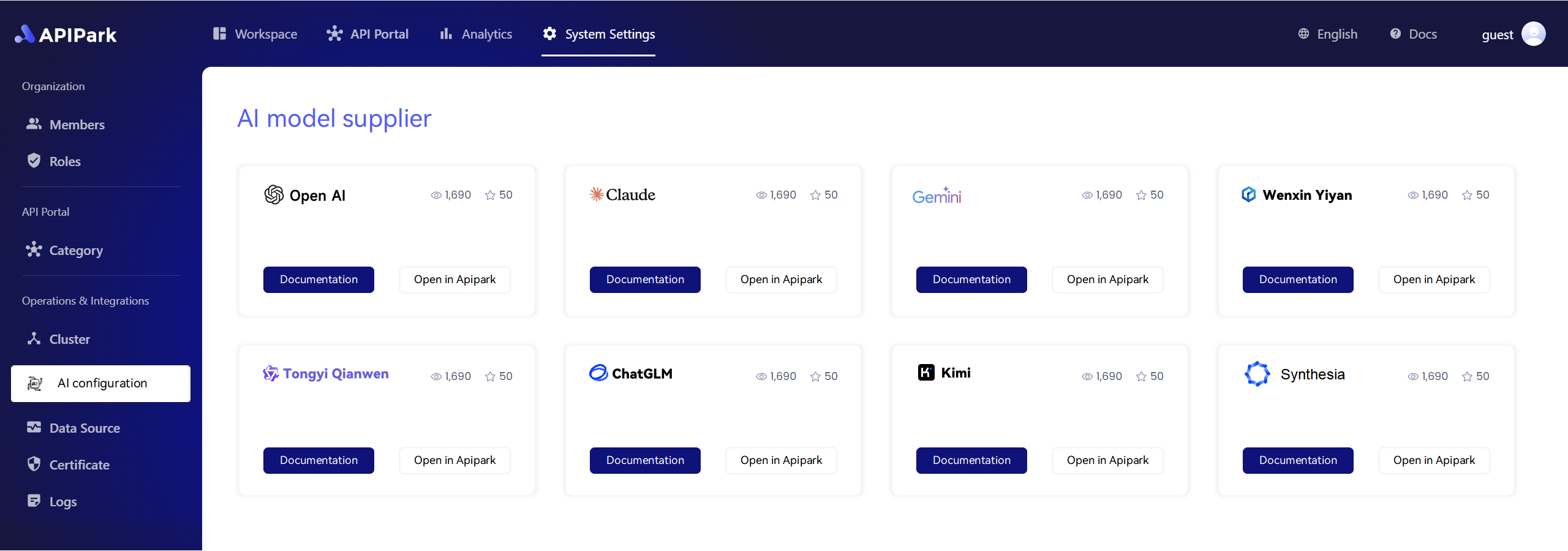

APIPark is a high-performance AI gateway that allows you to securely access the most comprehensive LLM APIs globally on the APIPark platform, including OpenAI, Anthropic, Mistral, Llama2, Google Gemini, and more.Try APIPark now! 👇👇👇

As technology advances, the importance of security measures such as API security, Basic Auth, AKSK, and JWT will only increase, shaping the future landscape of the insurance industry. By staying ahead of these trends, Crum and Forster will continue to provide valuable solutions and adapt to the evolving needs of their clientele.

This article covers the essential aspects of Crum and Forster’s insurance services, the pivotal role of technology, and the significance of maintaining high security standards in the digital insurance space. By understanding these facets, clients can make informed decisions and fully utilize the offerings of Crum and Forster.

🚀You can securely and efficiently call the OPENAI API on APIPark in just two steps:

Step 1: Deploy the APIPark AI gateway in 5 minutes.

APIPark is developed based on Golang, offering strong product performance and low development and maintenance costs. You can deploy APIPark with a single command line.

curl -sSO https://download.apipark.com/install/quick-start.sh; bash quick-start.sh

In my experience, you can see the successful deployment interface within 5 to 10 minutes. Then, you can log in to APIPark using your account.

Step 2: Call the OPENAI API.