When it comes to navigating the often complex landscape of insurance services, Crum and Forster stands out as a reputable player with a broad range of offerings. Their history dates back to 1822, establishing themselves as a trusted provider of innovative risk management solutions. As they continue to modernize their services, they leverage technology, including API security measures, to enhance client experiences and operational efficiency. This comprehensive guide will delve into Crum and Forster’s insurance services, the technologies powering their operations, and the significance of API security in today’s digital economy.

Overview of Crum and Forster’s Insurance Services

Crum and Forster operates through a myriad of segments tailored to various industries and personal needs. Their services include:

-

Property and Casualty Insurance: This segment covers a variety of risks including business liability, property damage, and motor vehicle accidents.

-

Specialty Insurance: Catering to unique industries, this service includes management liability, environmental risks, and professional liability coverage.

-

Workers’ Compensation: Aimed at protecting employees injured on the job, this insurance helps manage costs related to workplace injuries.

-

Surety Bonds: This coverage guarantees the performance of a contractor or a party in contractual obligations, bolstering trust and reliability in business transactions.

-

Personal Insurance: Covering homeowners, automobile, and HO-3 policies to protect individual members of society against various risks.

Each of these segments not only reflects the diverse nature of insurance needs but also the tailored solutions that Crum and Forster provide, allowing businesses and individuals to mitigate risks effectively.

| Service Category | Description |

|---|---|

| Property and Casualty | Coverage against property damage and liabilities |

| Specialty Insurance | Risk management for unique industries |

| Workers’ Compensation | Coverage for job-related injuries |

| Surety Bonds | Assurance of contractual obligations |

| Personal Insurance | Protection for individuals’ homes and automobiles |

The Role of Technology in Insurance

In today’s digital-first environment, traditional insurance models are increasingly intertwining with advancements in technology, primarily through the use of **and Azure for seamless operations. Crum and Forster is no exception, as they integrate various technologies to improve service delivery, enhance customer experiences, and streamline processes.

API Security

API (Application Programming Interface) security is critical in ensuring that the interactions between software applications are secure from potential attacks. Given the sensitive nature of insurance data, Crum and Forster emphasizes API security as a primary component of their digital strategy. This involves implementing best practices to protect the integrity and confidentiality of data being transferred between applications and systems.

With the increasing reliance on APIs to perform crucial functions such as policy management and client interactions, ensuring these APIs are secure is essential for maintaining customer trust and regulatory compliance.

Azure and Gateway Services

Utilizing Azure cloud services provides Crum and Forster with robust data storage, analytics capabilities, and operational scalability. Azure allows for secure management of insurance data, enabling the company to leverage extensive data analytics for better risk assessment and personalized services.

The integration of gateway services acts as a protective layer between users and services, enabling seamless interface for API management while ensuring that only authenticated requests are acted upon. This not only enhances operational efficiency but also strengthens overall security against external threats.

API Runtime Statistics

Monitoring API runtime performance is paramount to ensuring that the APIs operate smoothly and efficiently. Crum and Forster utilizes API Runtime Statistics to analyze trends in API calls, response times, and usage levels. These metrics provide valuable insights, allowing the company to fine-tune services, troubleshoot bottlenecks in real-time, and ensure a responsive client experience.

Why Choose Crum and Forster?

-

Experience & Trust: With nearly 200 years in the industry, Crum and Forster’s experience translates into reliability for clients.

-

Customized Solutions: They understand that no two businesses or individuals have the same requirements; hence their ability to customize solutions based on specific needs.

-

Innovative Technology: Their integration of cutting-edge technology and strong focus on API security ensures that clients receive the best service without compromising on security or performance.

-

Strong Support Network: With a dedicated team and support structure, Crum and Forster ensures that clients have access to expert advice and assistance whenever needed.

-

Comprehensive Coverage: Whether it’s property insurance, casualty, or specialty lines, Crum and Forster offers a comprehensive suite of insurance products to guard against a wide array of risks.

Conclusion

In a fast-evolving insurance landscape, Crum and Forster not only leverages its extensive experience but also stays ahead by integrating technology and maintaining a strong focus on API security. Offering comprehensive insurance solutions that cater to both personal and business needs, they have positioned themselves as a leading choice for many.

With features like Azure implementation, gateway services, and API runtime statistics, Crum and Forster demonstrates a commitment to innovating their services while ensuring that security remains a top priority. As more clients recognize the value of these services, Crum and Forster continues to build its reputation as a trustworthy insurance partner.

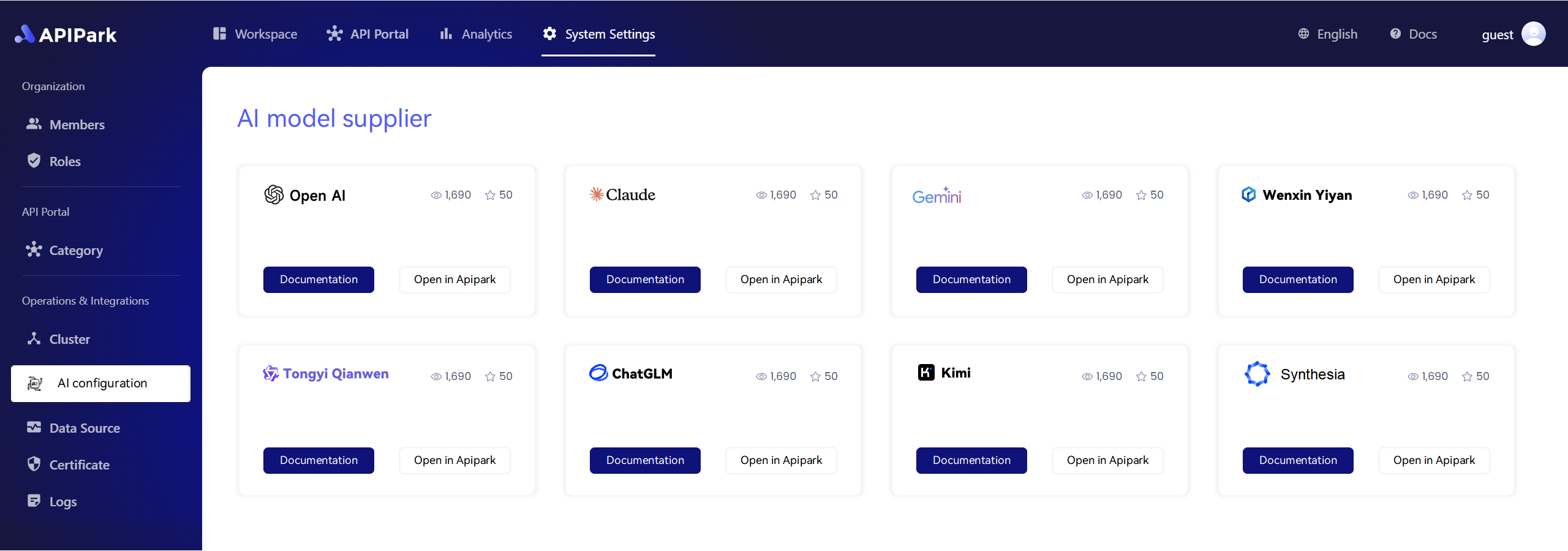

APIPark is a high-performance AI gateway that allows you to securely access the most comprehensive LLM APIs globally on the APIPark platform, including OpenAI, Anthropic, Mistral, Llama2, Google Gemini, and more.Try APIPark now! 👇👇👇

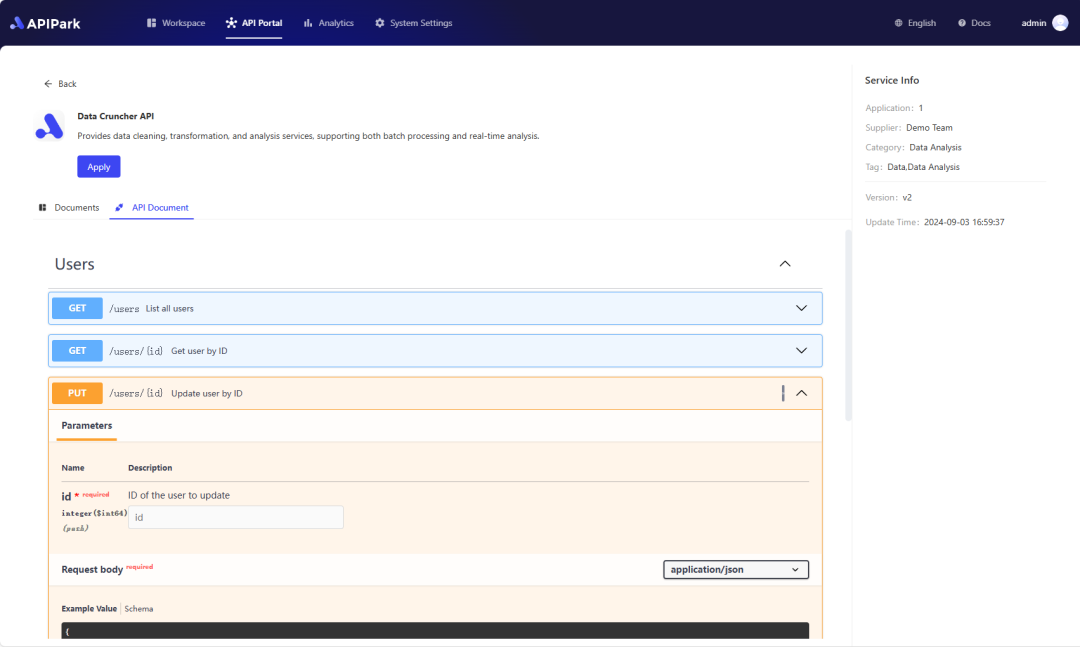

Example of API Service Call

To illustrate how Crum and Forster may implement API services for their clients, here is a simple example of an API request using curl. This example demonstrates how users can authenticate and send data to retrieve insurance policy details.

curl --location 'https://api.crumandforster.com/v1/policies' \

--header 'Content-Type: application/json' \

--header 'Authorization: Bearer your_api_token' \

--data '{

"policy_id": "123456",

"action": "getPolicyDetails"

}'

In this example, ensure that you replace your_api_token with your actual API authentication token to successfully retrieve details.

The Future of Insurance with Crum and Forster

In conclusion, Crum and Forster stands as a beacon of innovation in the insurance sector. As they continue to harness the advantages of technology, including strong API security practices, they are undoubtedly paving the way for a more secure, efficient, and client-focused insurance experience. With their extensive service offerings and commitment to excellence, choosing Crum and Forster means investing in a future where you and your assets are safely protected.

🚀You can securely and efficiently call the Gemini API on APIPark in just two steps:

Step 1: Deploy the APIPark AI gateway in 5 minutes.

APIPark is developed based on Golang, offering strong product performance and low development and maintenance costs. You can deploy APIPark with a single command line.

curl -sSO https://download.apipark.com/install/quick-start.sh; bash quick-start.sh

In my experience, you can see the successful deployment interface within 5 to 10 minutes. Then, you can log in to APIPark using your account.

Step 2: Call the Gemini API.