Production operations are a critical component of any insurance company. They represent a nexus of activities that ensure the smooth running of the business, maintaining customer satisfaction, and sustaining regulatory compliance. However, many may wonder, what does production operations in insurance company do? In this comprehensive article, we will delve into the complexities of production operations within the insurance sector and explore essential tools and frameworks such as APIPark, API Governance, and the Espressive Barista LLM Gateway that enhance the operational efficiency of these organizations.

Introduction to Production Operations in Insurance Companies

At the core of every insurance company lies its production operations, which encompass various activities from the implementation of policies to customer service management. They are responsible for streamlining processes, ensuring quality assurance, and securing regulatory compliance—all of which are imperative for the long-term sustainability of an insurance organization.

The typical functions of production operations within insurance companies include:

– Policy Management: Overseeing the lifecycle of insurance products, from development and launch to policyholder management and renewal.

– Claims Processing: Managing the assessment, evaluation, and payment of insurance claims.

– Customer Support: Providing assistance and services to clients throughout their journey with the insurance provider.

– Regulatory Compliance: Ensuring all operations align with state and federal regulations, safeguarding the organization against legal issues.

– Performance Monitoring: Utilizing data and analytics to assess productivity, efficiency, and areas for improvement within operations.

Key Responsibilities in Production Operations

Production operations in insurance companies involve a myriad of responsibilities, each playing a crucial role in driving the business’s overall success. Let’s explore these key responsibilities in detail:

1. Policy Development and Implementation

Insurance product lines must be meticulously crafted to meet the needs of the market and comply with governing regulations. This includes:

– Conducting market research to identify gaps and opportunities for new offerings.

– Tracking market trends that could affect product viability.

2. Underwriting and Risk Assessment

To underwrite policies, production operations must:

– Evaluate risks associated with potential policyholders.

– Ensure adherence to internal guidelines as well as legal frameworks to mitigate against losses.

3. Claims Handling

Claims processing is critical to the reputation and operational integrity of an insurance company. Responsibilities include:

– Analyzing claims to determine legitimacy.

– Collaborating with third-party adjusters to expedite claim resolution.

4. Customer Relationship Management

Building and maintaining positive relationships with clients is paramount. Functions include:

– Providing support throughout the policy lifecycle to enhance customer satisfaction.

– Gather feedback to implement service improvements.

5. Performance Analytics

The final responsibility includes continuous improvement through:

– Analyzing operational metrics, such as turnaround times and customer satisfaction scores.

– Implementing strategies based on performance data to optimize productivity.

The Importance of API Governance in Production Operations

As technology permeates the insurance industry, effective API governance is crucial for maintaining operational integrity. APIs (Application Programming Interfaces) enable seamless integration of applications and drive efficiencies in product and service delivery.

Benefits of API Governance in Insurance

- Resource Management: Ensures proper utilization of APIs to reduce costs and enhance process efficiency.

- Standardization: Creates a uniform approach to API deployment and management, which is vital for maintaining system coherence.

- Security: API governance frameworks establish protocols for securing sensitive customer data and ensuring compliance with privacy laws.

Implementing API Governance

Implementing API governance involves establishing a committee, defining governance policies, and setting performance metrics for continuous improvement. Here’s a simple breakdown:

| Step | Description |

|---|---|

| Define Objectives | Establish clear goals for API usage across the organization. |

| Set Rules and Protocols | Develop specific guidelines for API design and implementation. |

| Monitor and Audit | Regularly review API usage and performance for adherence to guidelines. |

| Continuous Improvement | Use feedback and data to refine API governance practices. |

Integration with Espressive Barista LLM Gateway

The use of advanced AI and machine learning technologies further enhances operational efficiency. The Espressive Barista LLM Gateway facilitates streamlined communication and automation for production operations. Here’s how it contributes:

- Automated Customer Interactions: AI-driven chatbots can assist clients in real-time, providing answers to common inquiries and guiding them through claims processes.

- Data Processing: Machine learning algorithms can analyze vast amounts of transactional data, helping underwriting teams assess risks more accurately.

API Key and Basic Identity Authentication

With the integration of these technologies, API management becomes essential. API Keys are utilized for Basic Identity Authentication, ensuring that access to sensitive data is securely controlled. Admins can generate and distribute API Keys to main stakeholders—enhancing security protocols and safeguarding against data breaches.

Here is an example of how to configure API authentication when making a call to an API service:

curl --location 'http://your-insurance-api-endpoint/path' \

--header 'Content-Type: application/json' \

--header 'Authorization: Bearer YOUR_API_KEY' \

--data '{

"customer_id": "123456",

"policy_id": "654321"

}'

In this example, replace YOUR_API_KEY with your actual API Key, providing a secure mechanism for retrieving or submitting data.

The Future of Production Operations in Insurance

The landscape of production operations in insurance is evolving rapidly, driven by advancements in technology and shifting consumer expectations. Insurers must stay ahead of trends to remain competitive.

Embracing Digital Transformation

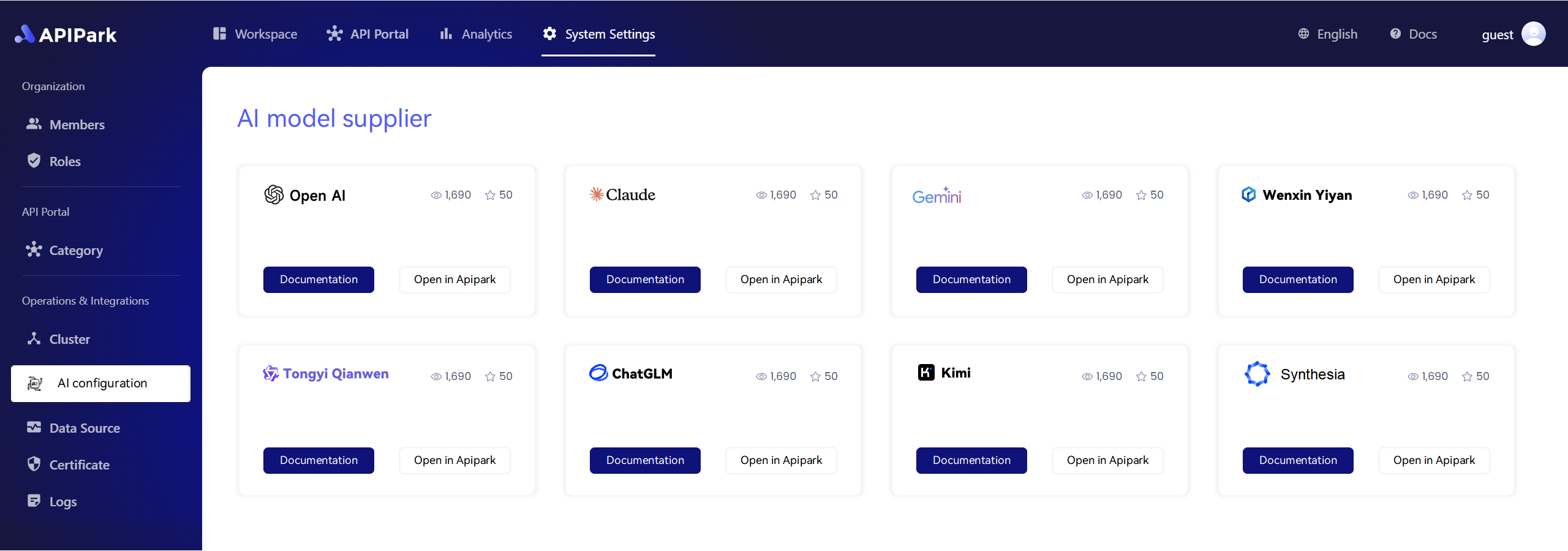

As customers increasingly demand seamless experiences, insurers must leverage technologies like APIPark for a more cohesive approach to API management, thereby facilitating easier interactions and enhancing service delivery.

Data Analytics and Artificial Intelligence

Utilizing data analytics is becoming non-negotiable. With tools like the Espressive Barista LLM Gateway, historical data can be interpreted in real-time, helping production operations dynamically respond to claims, market trends, and consumer behaviors.

Regulatory Challenges

Insurance companies must stay proactive in the face of evolving regulations. Thus, enhancing compliance frameworks will be pivotal in maintaining operations and public trust.

Conclusion

In conclusion, production operations are a multifaceted function that forms the backbone of insurance companies. The responsibilities encompass policy management, claims processing, customer support, regulatory compliance, and performance monitoring. With the integration of robust tools such as APIPark, API Governance, and AI-driven solutions like the Espressive Barista LLM Gateway, insurance organizations can significantly enhance operational efficiency and customer satisfaction. Adapting to the changing landscape of technology and regulations will be essential for the continued success of production operations in the insurance industry.

APIPark is a high-performance AI gateway that allows you to securely access the most comprehensive LLM APIs globally on the APIPark platform, including OpenAI, Anthropic, Mistral, Llama2, Google Gemini, and more.Try APIPark now! 👇👇👇

Through a thorough understanding of these elements, stakeholders within insurance companies can better appreciate the complexity and importance of production operations, ultimately leading to stronger, more resilient organizations in the competitive insurance landscape.

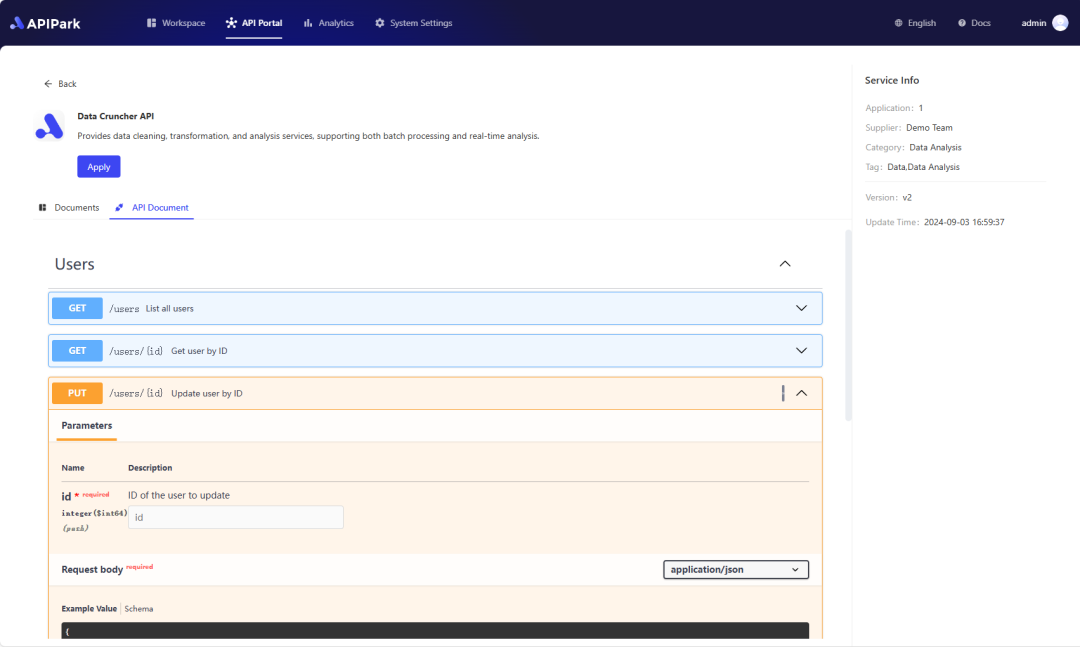

🚀You can securely and efficiently call the 月之暗面 API on APIPark in just two steps:

Step 1: Deploy the APIPark AI gateway in 5 minutes.

APIPark is developed based on Golang, offering strong product performance and low development and maintenance costs. You can deploy APIPark with a single command line.

curl -sSO https://download.apipark.com/install/quick-start.sh; bash quick-start.sh

In my experience, you can see the successful deployment interface within 5 to 10 minutes. Then, you can log in to APIPark using your account.

Step 2: Call the 月之暗面 API.