In recent years, financial markets have experienced a seismic shift due to advancements in artificial intelligence (AI), particularly through the introduction and proliferation of cloud-based large language models (LLMs). These transformative tools not only enhance market efficiency but also empower organizations with sophisticated analytics capabilities. In this comprehensive guide, we will delve into how cloud-based LLM trading is reshaping financial markets while also ensuring that enterprises use AI securely.

The Rise of AI in Financial Markets

Understanding LLMs

Large Language Models, or LLMs, represent a breakthrough in AI technology. They process vast amounts of text data and can generate human-like text outputs, providing insights, predictions, and automation across various sectors, including finance. The capability of LLMs to analyze historical market data, interpret news, and predict trends makes them invaluable in trading scenarios.

The Benefits of Cloud-Based Solutions

Cloud computing offers several advantages, especially for financial organizations looking to implement LLM trading strategies. By leveraging cloud-based LLMs, firms can take advantage of scalability, flexibility, and cost-effectiveness. They eliminate the need to invest heavily in on-premises hardware, making sophisticated AI applications available to a wider range of businesses, from large institutions to smaller firms.

| Benefit | Description |

|---|---|

| Scalability | Cloud resources can be easily scaled up or down based on demand, allowing firms to manage resources effectively. |

| Cost-Effectiveness | Reduces costs related to hardware, maintenance, and energy consumption. |

| Accessibility | Enables remote access to data and applications, facilitating real-time decision-making. |

| Security | Cloud providers invest heavily in robust security measures to protect sensitive data. |

Enhancing Enterprise Security with AI

As organizations embrace AI technologies, ensuring that they do so securely is paramount. With the increasing reliance on AI in financial transactions and analytics, enterprises must implement stringent security measures to safeguard sensitive data.

Key Security Measures

- Data Encryption: Encrypting sensitive financial data ensures that even if data leaks occur, the information remains secure.

- Access Control: Utilizing role-based access controls to restrict data access based on user roles minimizes the risks associated with unauthorized access.

- Audit Logs: Maintaining detailed logs of all AI interactions allows for efficient tracking and auditing of data usage.

- Compliance Frameworks: Adhering to regulatory guidelines, such as GDPR and PCI-DSS, ensures organizations meet legal obligations concerning data protection.

By establishing these measures, organizations can leverage AI solutions like LiteLLM while ensuring the integrity and confidentiality of their data.

LiteLLM: A Game-Changer in Cloud-Based Trading

LiteLLM serves as a specific example of how cloud-based solutions are being utilized in trading. As a lightweight language model tailored for financial applications, LiteLLM offers fast processing times without compromising accuracy. Its capabilities allow traders to deploy algorithms that respond in real-time to market changes and customer inquiries, significantly enhancing trading efficiency.

Core Features of LiteLLM

- Fast Deployment: LiteLLM can be quickly configured and deployed, allowing traders to respond to market opportunities faster.

- User-Friendly Integration: With robust APIs, LiteLLM integrates seamlessly with existing trading platforms and workflows.

- Predictive Analytics: Provides valuable insights by analyzing market sentiments and trends based on real-time data.

The integration of LiteLLM into trading platforms signifies a move towards more automated and intelligent trading solutions.

AI Gateway and Traffic Control

To effectively leverage cloud-based LLMs in trading, robust management of AI services is essential. An AI gateway is a crucial component that facilitates communication between the front-end systems and the LLM back-end. By acting as a mediator, it streamlines requests and optimizes data traffic between various components.

Importance of Traffic Control

Efficient traffic control mechanisms are vital as they ensure that API requests are managed effectively to prevent system overloads. Traffic control enables organizations to:

- Prioritize Requests: Critical trading actions can be prioritized to ensure minimal latency and faster execution.

- Load Balancing: Distributing workloads evenly across servers to enhance performance and uptime.

- Rate Limiting: Preventing abuse and ensuring fair use of resources by limiting the number of requests a user can make in a given timeframe.

By implementing a robust AI Gateway with effective traffic control, organizations can enhance their operational efficiency while utilizing LLM technologies.

The Future of Cloud-Based LLM Trading

Transformational Impacts on Financial Markets

The integration of cloud-based LLM trading systems has profound implications for financial markets:

- Increased Efficiency: Automated trading processes powered by AI can lead to faster transaction times and improved liquidity.

- Enhanced Decision Making: By analyzing large datasets in real-time, traders can make more informed decisions, minimizing risks and maximizing returns.

- Customization: Investors can personalize their trading strategies through automated insights generated from AI analyses tailored to their preferences.

Challenges Ahead

As we embrace the future of AI-powered trading, several challenges remain. Security threats such as data breaches and algorithmic manipulation pose significant risks. Organizations must prioritize building resilient systems that safeguard against these threats while ensuring compliance with regulations.

Conclusion

Cloud-based LLM trading is unlocking unprecedented opportunities in financial markets. By embracing these advanced technologies and ensuring their secure application, enterprises can navigate the complexities of modern trading landscapes efficiently. As we move forward, the synergy between AI and finance will continue to evolve, promising even greater innovations and efficiencies for businesses willing to embrace change.

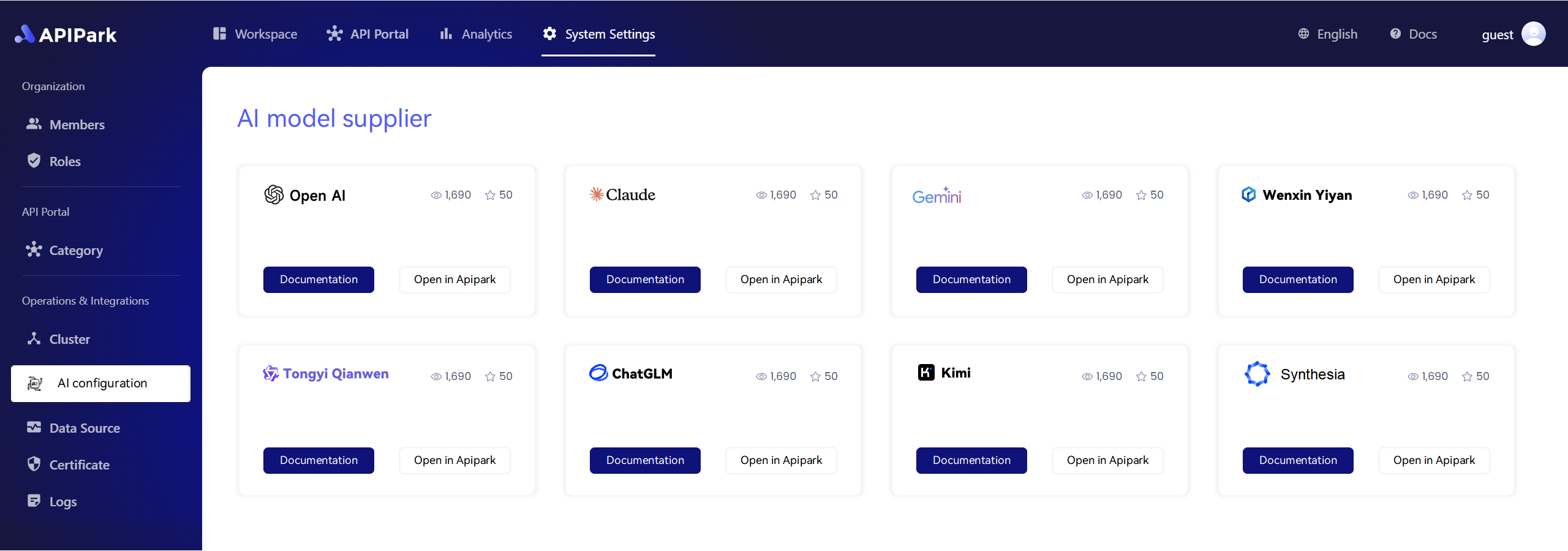

APIPark is a high-performance AI gateway that allows you to securely access the most comprehensive LLM APIs globally on the APIPark platform, including OpenAI, Anthropic, Mistral, Llama2, Google Gemini, and more.Try APIPark now! 👇👇👇

Incorporating AI like LiteLLM into trading systems represents a leap toward a new era in finance, and with it comes the responsibility of ensuring enterprise security using AI methodologies. Through effective strategies, organizations can thrive in an environment where data-driven decision-making becomes the norm. As cloud technologies advance, the synergy between AI and financial markets will undoubtedly unlock even more opportunities for growth and transformation.

In the coming years, expect cloud-based LLM trading to continue dominating financial landscapes, setting new standards for efficiency, security, and innovative trading practices.

🚀You can securely and efficiently call the Tongyi Qianwen API on APIPark in just two steps:

Step 1: Deploy the APIPark AI gateway in 5 minutes.

APIPark is developed based on Golang, offering strong product performance and low development and maintenance costs. You can deploy APIPark with a single command line.

curl -sSO https://download.apipark.com/install/quick-start.sh; bash quick-start.sh

In my experience, you can see the successful deployment interface within 5 to 10 minutes. Then, you can log in to APIPark using your account.

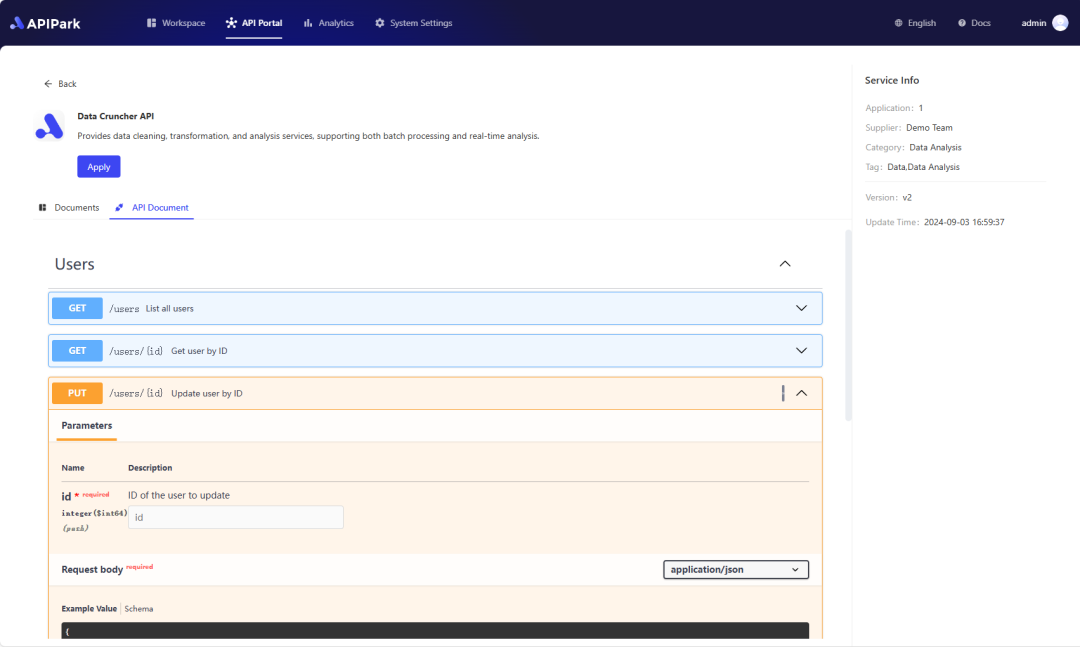

Step 2: Call the Tongyi Qianwen API.