In the rapidly evolving landscape of the insurance industry, production operations play a crucial role in maintaining efficiency, ensuring security, and enhancing customer satisfaction. This article will delve into the multifaceted responsibilities of production operations in insurance companies, focusing on how they can leverage technologies like API security, OpenAPI specifications, and tools like Traefik for seamless processes.

Table of Contents

- Introduction to Production Operations in Insurance

- The Necessity of Production Operations

- APIs in Insurance Production Operations

- 3.1 API Security

- 3.2 OpenAPI Specifications

- 3.3 API Exception Alerts

- Traefik: Managing Traffic in Insurance Operations

- Best Practices for Production Operations

- Conclusion

1. Introduction to Production Operations in Insurance

Production operations within insurance companies encompass a range of activities critical to functional success. They serve as the backbone of insurance service offerings, ensuring that processes from policy underwriting to claims processing are carried out smoothly and effectively. But what does production operations in an insurance company do? Essentially, it involves the oversight of all operational aspects to guarantee effective service delivery.

This role is even more essential as insurers increasingly incorporate digital solutions into their services, requiring robust operational frameworks that utilize technology for improved efficiency and customer engagement.

2. The Necessity of Production Operations

As insurance companies face an ever-growing demand for quick and reliable service, the necessity for well-structured production operations becomes increasingly vital. These operations ensure regulatory compliance, risk management, and quality assurance across various disciplines.

| Role | Description |

|---|---|

| Process Efficiency | Streamlining operations for faster service delivery. |

| Regulatory Compliance | Ensuring adherence to laws and regulations. |

| Customer Satisfaction | Enhancing service delivery to improve customer engagement. |

| Risk Management | Identifying and mitigating operational risks. |

The incorporation of APIs (Application Programming Interfaces) has become a game-changer for insurance companies. They facilitate seamless communication across various platforms, streamlining operations in ways that manual processes cannot match.

3. APIs in Insurance Production Operations

Employing APIs significantly transforms the production operations landscape within insurance companies. From connecting various internal systems to integrating third-party services, APIs open up a multitude of opportunities.

3.1 API Security

As types of data breaches continue to plague various industries, this becomes a primary concern. API security ensures that sensitive customer data is protected from unauthorized access and cyber threats. Insurance companies often handle vast amounts of personal and financial information, making API security one of the top priorities. Key strategies include:

- Authentication and Authorization: Ensuring only authorized personnel can access sensitive information.

- Data Encryption: Implementing encryption protocols to protect data in transit and at rest.

- Monitoring and Auditing: Continuous monitoring of API usage to identify potential threats or irregularities.

Implementing API security measures not only safeguards customer data but also strengthens the insurance brand’s reputation in a competitive marketplace.

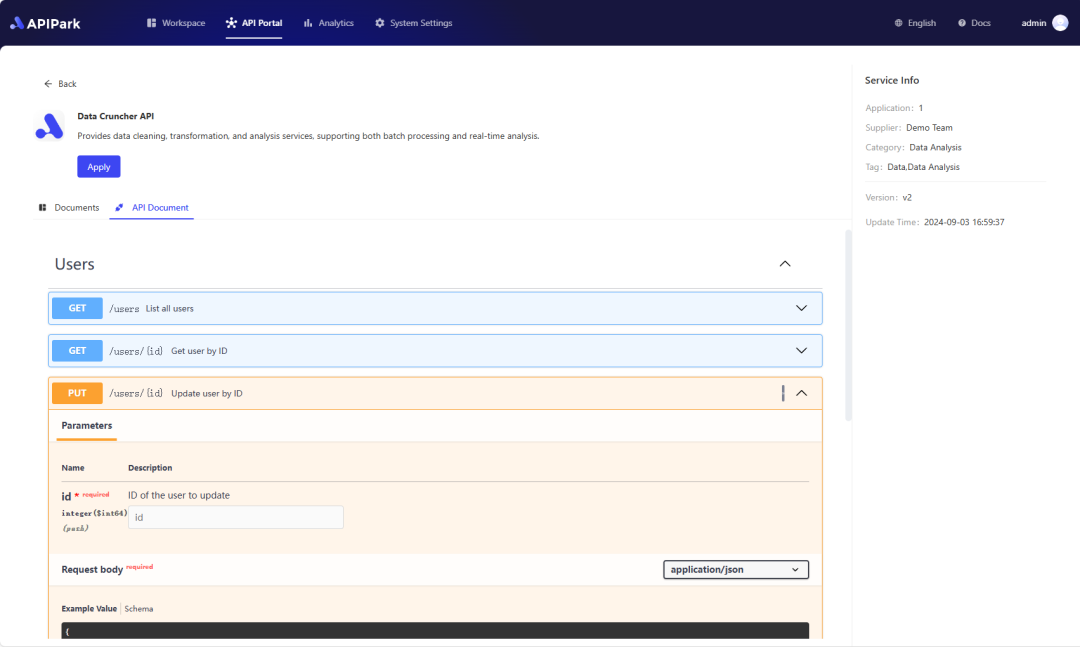

3.2 OpenAPI Specifications

OpenAPI, formerly known as Swagger, is a framework that simplifies the documentation of APIs. In the insurance sector, using OpenAPI specifications helps clarify how various services interact, which is essential for maintenance, updates, and debugging.

The key benefits of employing OpenAPI specifications include:

- Enhanced Documentation: Providing clear, concise API documentation that can be easily understood by developers and stakeholders.

- Integration Facilitation: Simplifying the process to integrate with external systems, enhancing collaboration.

- Testing and Debugging: Streamlining the testing process to identify issues before deployment.

3.3 API Exception Alerts

To ensure smooth operations, production teams in insurance companies utilize API exception alerts to indicate when something goes wrong in API interactions. These alerts work as an early warning system, allowing teams to:

- Identify Issues Quickly: Alerts enable prompt responses to downtime or system malfunctions.

- Improve Performance: By analyzing exceptions, teams can improve API performance and resilience.

- Enhance Customer Experience: Quick issue resolution directly affects customer satisfaction, ensuring seamless service delivery.

4. Traefik: Managing Traffic in Insurance Operations

Traefik is an open-source Edge Router that acts as a reverse proxy and load balancer, making it easier to manage incoming traffic to services. In the context of insurance production operations, Traefik can facilitate the following:

- Dynamic Configuration: Traefik automatically updates its routing configuration when new services are added or removed, ensuring constant connectivity.

- SSL Termination: It can handle SSL certificates, enhancing the security of data exchanged between the company and its clients.

- API Gateway Functionality: By serving as an API gateway, Traefik can manage all API calls, monitor traffic, and secure communications effectively.

Here’s a simple example of a configuration file for Traefik to manage routes for API services in an insurance company:

http:

routers:

api-router:

rule: "Host(`api.insurancecompany.com`)"

service: api-service

entryPoints:

- websecure

services:

api-service:

loadBalancer:

servers:

- url: "http://api-backend:8080"

In this configuration, Traefik is set to route traffic directed at api.insurancecompany.com to a backend service running on port 8080, enhancing operational flow and connectivity.

5. Best Practices for Production Operations

To optimize production operations, insurance companies should adhere to several best practices:

- Leverage Data Analytics: Employ analytic tools to assess operational performance and customer interactions to identify areas for improvement.

- Implement Regular Training: Continuous training for staff on the latest technologies and regulations can enhance efficiency and compliance.

- Foster Interdepartmental Collaboration: Encouraging collaboration across departments can streamline workflows and reduce response times for customer inquiries.

- Invest in Robust Cybersecurity Measures: Protecting customer data should be a priority, and investing in comprehensive cybersecurity measures is crucial.

- Continuously Review and Adapt Processes: Regular audits and review of operational workflows ensure that practices remain effective and efficient as market demands evolve.

6. Conclusion

In conclusion, understanding the role of production operations in insurance companies is critical for anyone working in the industry, from executives to entry-level employees. Ensuring seamless integration of technologies such as API security, OpenAPI specifications, and traffic management solutions like Traefik can provide significant advantages. As insurance companies continue to innovate, the role of production operations will only grow in importance, necessitating a focus on efficiency, security, and customer satisfaction. By employing best practices and embracing technological advancements, companies can thrive in a competitive market while delivering excellent service to their customers.

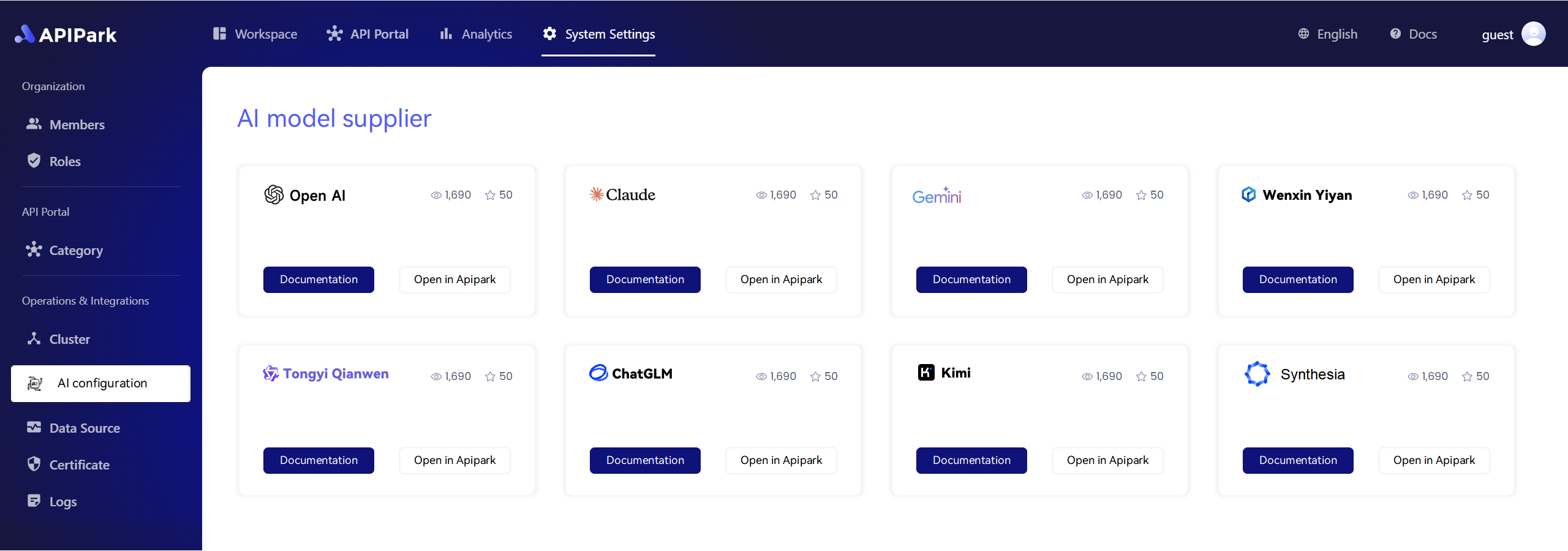

APIPark is a high-performance AI gateway that allows you to securely access the most comprehensive LLM APIs globally on the APIPark platform, including OpenAI, Anthropic, Mistral, Llama2, Google Gemini, and more.Try APIPark now! 👇👇👇

This comprehensive understanding of production operations in insurance companies highlights the importance of technological innovation and efficient process management in the industry. By leveraging the right tools and practices, insurance companies can ensure they stay ahead of the curve in a rapidly changing landscape.

🚀You can securely and efficiently call the 文心一言 API on APIPark in just two steps:

Step 1: Deploy the APIPark AI gateway in 5 minutes.

APIPark is developed based on Golang, offering strong product performance and low development and maintenance costs. You can deploy APIPark with a single command line.

curl -sSO https://download.apipark.com/install/quick-start.sh; bash quick-start.sh

In my experience, you can see the successful deployment interface within 5 to 10 minutes. Then, you can log in to APIPark using your account.

Step 2: Call the 文心一言 API.