In the insurance industry, production operations are critical for ensuring that all processes run smoothly and efficiently. This domain not only encompasses the day-to-day tasks within insurance organizations but also involves strategic planning and overall operational management. As the industry increasingly adopts technology, the integration of AI systems and platforms, such as APIPark, becomes essential for ensuring corporate safety while utilizing AI resources. In this article, we will delve deep into the functions, benefits, and challenges of production operations in insurance companies, while also exploring the implications of utilizing AI technologies.

What Does Production Operations in Insurance Companies Do?

Production operations in insurance companies refer to the management and optimization of various processes involved in policy development, underwriting, claims handling, customer service, and overall operational effectiveness. The production operations team is responsible for producing insurance policies, implementing regulatory compliance, and ensuring the organization functions within predefined limits.

Key Responsibilities of Production Operations in Insurance

-

Policy Development and Management: Production operations oversee the creation and maintenance of insurance policies. This involves assessing risk factors, defining coverage parameters, and aligning products with customer needs while also adhering to legal regulations.

-

Underwriting Process: Underwriting is integral to insurance; it determines the criteria under which policies are issued. Production operations involve risk evaluation and pricing decisions, ensuring profitability while managing risk exposure.

-

Claims Processing: This includes the management of claims from inception to resolution. Production operations ensure timely claims handling to increase customer satisfaction and operational efficiency.

-

Policy Administration: Managing policy records, renewals, and modifications fall under production operations. These tasks require data integrity and an efficient information management system.

-

Collaboration and Communication: It involves facilitating communication among various departments like underwriting, sales, and claims. Effective collaboration is foundational for seamless operations and customer satisfaction.

-

Performance Monitoring: Utilizing data analytics, the production operations team assesses performance metrics, monitors productivity levels, and identifies areas for improvement.

The Role of AI in Production Operations

With the integration of advanced technology, especially Artificial Intelligence (AI), insurance companies have significantly enhanced their production operations. AI enables automation of repetitive tasks, provides insights from large datasets, and improves decision-making processes.

Benefits of Using AI in Production Operations

-

Enhanced Efficiency: AI-powered tools can automate mundane tasks such as data entry and claims assessments, allowing employees to focus on critical strategic functions.

-

Improved Accuracy: AI systems can analyze vast amounts of data quickly with a high degree of accuracy. This reduces errors in underwriting, risk assessment, and claims processing.

-

Real-time Analytics and Reporting: Advanced AI systems can offer real-time insights into operational metrics, enabling proactive decision-making and quick responses to market changes.

-

Customer Experience: AI applications improve decision-making, speed up processing times, and tailor services based on customer preferences, thereby enhancing overall customer satisfaction.

-

Risk Management: With predictive analytics, AI can assist production operations in identifying potential risks and taking preventive measures.

Incorporating AI into insurance production operations fosters a competitive edge, driving efficiency and effectiveness.

Sample Diagram of AI Integration in Production Operations in Insurance Companies

| Phase | Traditional Method | AI-powered Method |

|---|---|---|

| Policy Development | Manual evaluations and lengthy processing times | Automated assessments and instant feedback |

| Underwriting | Risk analysis done by teams with limited tools | AI-driven risk evaluations using vast datasets |

| Claims Handling | Claims processed manually, leading to delays | Automated claims assessments for quicker processing |

| Data Management | Paper-based systems leading to inaccuracies | Centralized digital storage with AI analytics |

Ensuring Corporate Safety While Utilizing AI

While the advantages of AI are significant, the use of AI in production operations comes with concerns, particularly regarding data security and corporate governance. Here are some essential practices to ensure safe usage of AI in insurance companies:

-

Data Management Policies: Establish strict data management guidelines that comply with industry standards and regulations.

-

Robust Security Protocols: Implement robust security measures, including encryption and access controls, to protect sensitive information and customer data.

-

Compliance and Auditing: Regularly review AI tools and processes to ensure they comply with regulations and company policies.

-

Risk Assessment: Conduct thorough assessments to identify potential risks associated with AI implementations, refining processes accordingly.

-

Employee Training: Provide employees with necessary training on how to leverage AI tools responsibly while understanding associated risks.

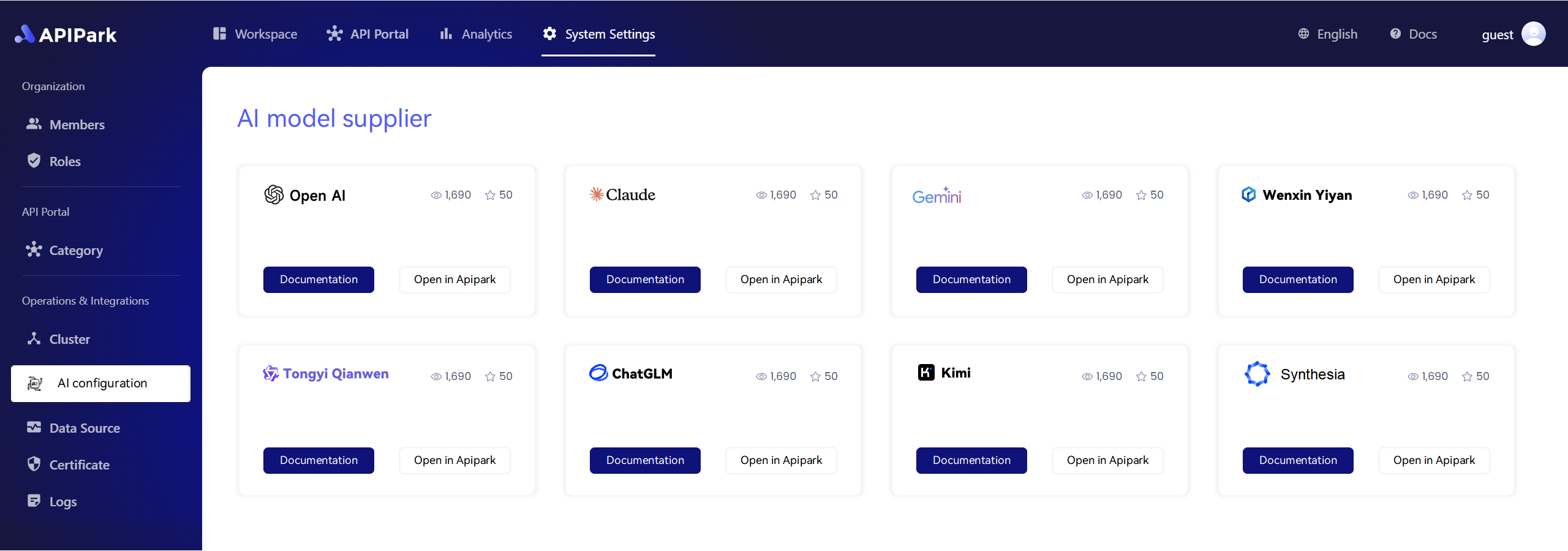

APIPark is a high-performance AI gateway that allows you to securely access the most comprehensive LLM APIs globally on the APIPark platform, including OpenAI, Anthropic, Mistral, Llama2, Google Gemini, and more.Try APIPark now! 👇👇👇

Common Challenges in Production Operations

Despite the advancements in technology and AI, insurance companies face numerous challenges in their production operations:

-

Change Management: Transitioning to AI or new technologies can meet resistance from employees. Proper change management strategies are essential for ensuring smooth transitions.

-

Integrating Legacy Systems: Many insurance firms rely on older systems that may not be compatible with modern AI tools. Bridging the gap between old and new technologies can be difficult.

-

Data Quality Issues: The effectiveness of AI depends heavily on data quality. Poor or inconsistent data can lead to inaccurate results and diminish the value of AI tools.

-

Compliance Risks: As regulations evolve, companies must ensure that their AI systems remain compliant to reduce risks associated with non-compliance.

Conclusion

In conclusion, production operations play a fundamental role in the overall success of insurance companies. The integration of AI technologies can enhance efficiency, accuracy, and customer satisfaction while ensuring corporate safety. By implementing robust management practices and embracing innovation, insurance companies can navigate challenges effectively and maintain a competitive edge in a rapidly changing landscape.

As the insurance landscape continues evolving, understanding the pivotal role of production operations and utilizing cutting-edge technologies will be vital in driving success and achieving operational excellence in the industry.

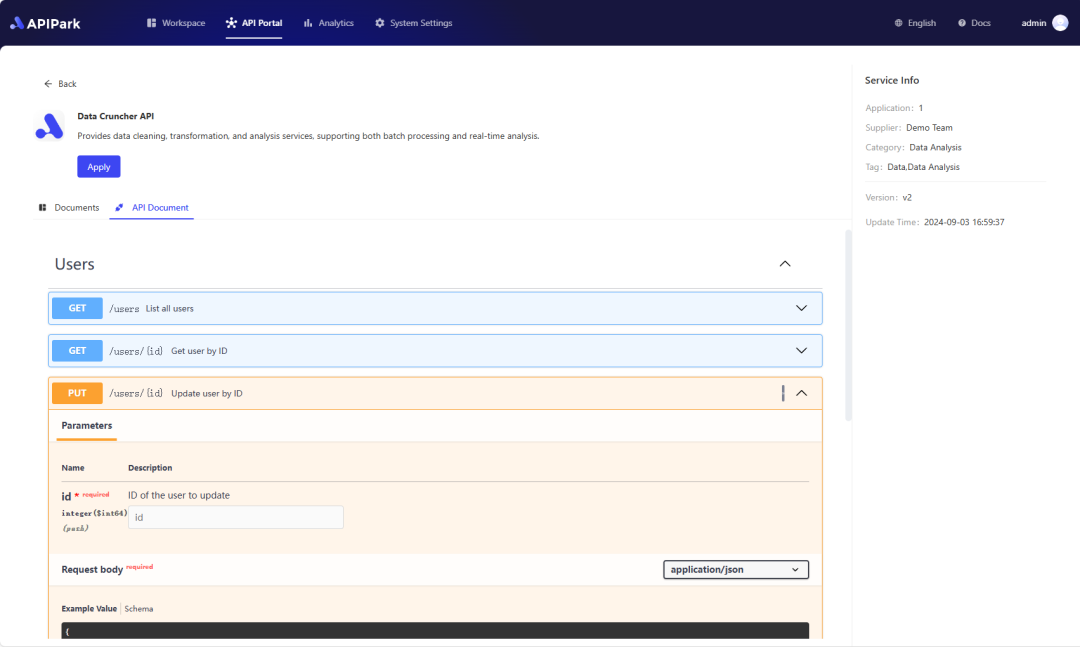

🚀You can securely and efficiently call the OPENAI API on APIPark in just two steps:

Step 1: Deploy the APIPark AI gateway in 5 minutes.

APIPark is developed based on Golang, offering strong product performance and low development and maintenance costs. You can deploy APIPark with a single command line.

curl -sSO https://download.apipark.com/install/quick-start.sh; bash quick-start.sh

In my experience, you can see the successful deployment interface within 5 to 10 minutes. Then, you can log in to APIPark using your account.

Step 2: Call the OPENAI API.