Crum and Forster, a leading insurance company established in the United States, has made a significant mark in the industry with its innovative insurance products and services. As businesses evolve and face new risks, the role of comprehensive and effective insurance solutions becomes paramount. This article aims to provide a thorough understanding of Crum and Forster’s insurance services and how they can be leveraged for enterprise safety, particularly with the integration of advanced technologies like AI and API management.

Introduction to Crum and Forster

Crum and Forster’s history dates back to 1822 and since then, the company has focused on providing high-quality insurance solutions. This includes various lines of coverage like property, casualty, specialty insurance, and workers’ compensation. With a dedication to meet the evolving needs of its clients, Crum and Forster has adapted its approach to incorporate advanced technology and enhance user experience, providing clients with scalable, flexible insurance solutions.

The Relevance of AI in Insurance

Artificial Intelligence (AI) is transforming various industries, including insurance. Companies like Crum and Forster have begun to utilize AI to streamline operations, assess risks, and improve customer service. The benefits of employing AI in insurance services are multifold:

- Enhanced Risk Assessment: AI algorithms analyze vast datasets, helping underwriters make more informed decisions.

- Customized Solutions: AI can tailor insurance policies according to individual client needs, improving satisfaction and retention.

- Fraud Detection: Machine learning algorithms can detect patterns indicative of fraud, ensuring claims are legitimate and protecting the company’s bottom line.

Using AI Responsibly: Ensuring Safe Enterprise Adoption

As noted, the integration of AI in businesses brings numerous advantages; however, it is crucial for organizations to adopt these tools responsibly. Here are several considerations for ensuring the enterprise safe use of AI:

- Data Privacy Compliance: Organizations must ensure that the data they collect and process complies with relevant data protection regulations.

- Bias Elimination: Developing AI algorithms requires ensuring the data input is unbiased, as this influences output accuracy.

Understanding API Lifecycle Management

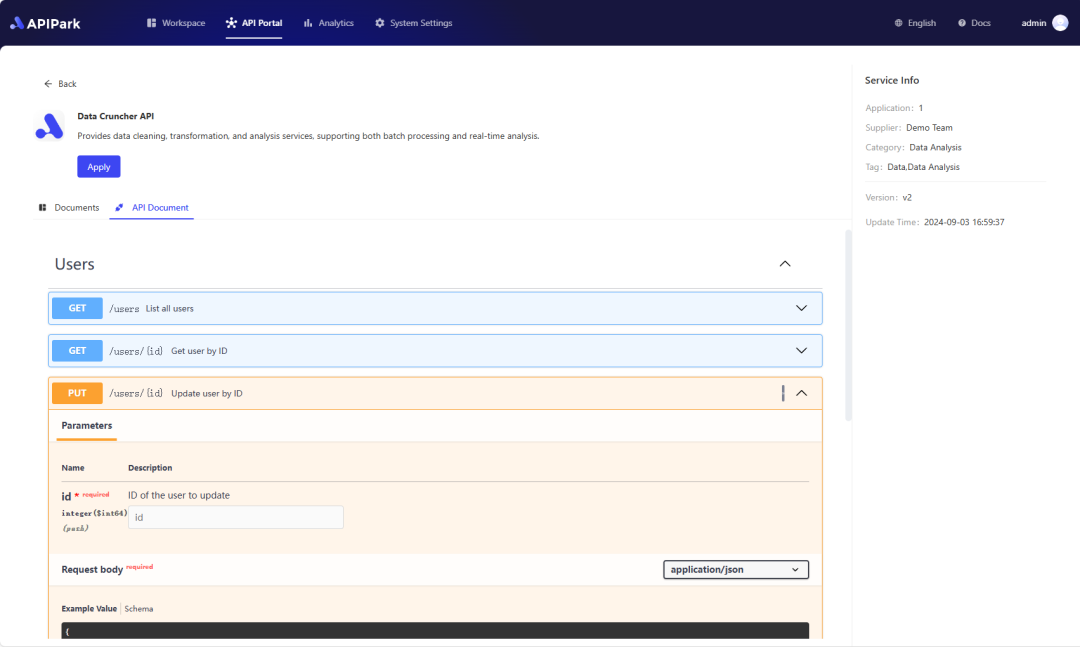

API Lifecycle Management is essential in today’s interconnected world. APIs (Application Programming Interfaces) allow disparate software systems to communicate effectively. They play a crucial role in enabling businesses to create integrated applications that can drive efficiency.

Why API Lifecycle Management Matters

Managing the lifecycle of an API involves its creation, deployment, monitoring, and eventual retirement. Proper management ensures that APIs are secure, reliable, and aligned with business goals. Crum and Forster recognizes the importance of API Lifecycle Management and integrates it into its operational strategy:

- Centralized Management: All API services can be managed from one location, ensuring that any issues can be quickly addressed.

- Enhanced Security: By managing APIs through a centralized platform, potential threats can be monitored and mitigated effectively.

Benefits of API Management with NGINX

NGINX serves as one of the most popular choices among businesses for API management due to its high performance and robust security. When combined with Crum and Forster’s technology strategy, NGINX offers:

- Load Balancing: As multiple requests are made, NGINX helps to distribute traffic efficiently across servers.

- Caché Management: Caching frequently requested data improves API performance by reducing response time.

Here’s a simple representation of how Crum and Forster’s insurance API management with NGINX could be structured:

| Service | Description | Benefits |

|---|---|---|

| API Gateway | Centralized point for managing existing APIs | Improved security & performance |

| Load Balancer | Distributes incoming traffic to optimize resource use | Decreased downtime |

| Caching Mechanism | Stores frequently accessed data for quick retrieval | Enhanced response times |

| Monitoring Tools | Tracks performance and usage analytics | Proactive issue resolution |

Crum and Forster’s Approach to Insurance Services

Crum and Forster’s insurance services encompass a variety of sectors, demonstrating their versatility and expertise. They provide Customized Insurance Solutions specifically tailored to industries such as:

- Healthcare: Offering comprehensive coverage that addresses the unique risks associated with the healthcare sector.

- Real Estate: Providing property insurance that safeguards clients against potential liabilities.

- Environmental Services: Insurance policies that address environmental risks and ensure compliance with regulations.

Each of these sectors requires a specialized approach, and Crum and Forster has positioned itself to cater to the diverse needs of its clientele by leveraging its insights and applying advanced technology.

Implementing AI Services: A Step-by-Step Approach

To maximize the benefits of AI in insurance services, a structured approach is essential. Below is a step-by-step guide on how Crum and Forster and similar organizations can implement AI services effectively.

Step 1: Identify Requirements

Before implementation, it is critical for companies to identify their specific needs. These could range from enhanced risk assessments to streamlined claims processing.

Step 2: Choose the Right AI Technologies

Selecting appropriate AI technologies that align with business goals is crucial. Options may include machine learning models for predictive analysis or chatbots for improved customer interaction.

Step 3: Integration with Existing Systems

AI solutions need to integrate seamlessly with existing insurance platforms. This is where API Lifecycle Management becomes critical. Ensuring that AI technologies function well with current systems will facilitate a smoother transition.

Step 4: Establish Monitoring and Maintenance Protocol

Once AI systems are operational, continuous monitoring and maintenance are necessary to identify potential issues and improve performance.

Step 5: Gather Feedback and Optimize

Regularly gathering user feedback will provide insights for improving AI systems. This iterative process ensures that the technology continually meets clients’ needs.

AI Service Call Example

The following is an example of a code snippet illustrating a basic API call to an AI service, showcasing how Crum and Forster could implement AI solutions in their insurance operations:

curl --location 'http://ai-service-provider.com/api/insurance' \

--header 'Content-Type: application/json' \

--header 'Authorization: Bearer your_api_token' \

--data '{

"client_profile": {

"industry": "Healthcare",

"size": "250 employees"

},

"analytical_request": {

"type": "risk_assessment",

"parameters": {

"claims_history": "recent",

"predictive_model": "standard"

}

}

}'

This example shows how Crum and Forster could automate risk assessments using an API connected to an AI service.

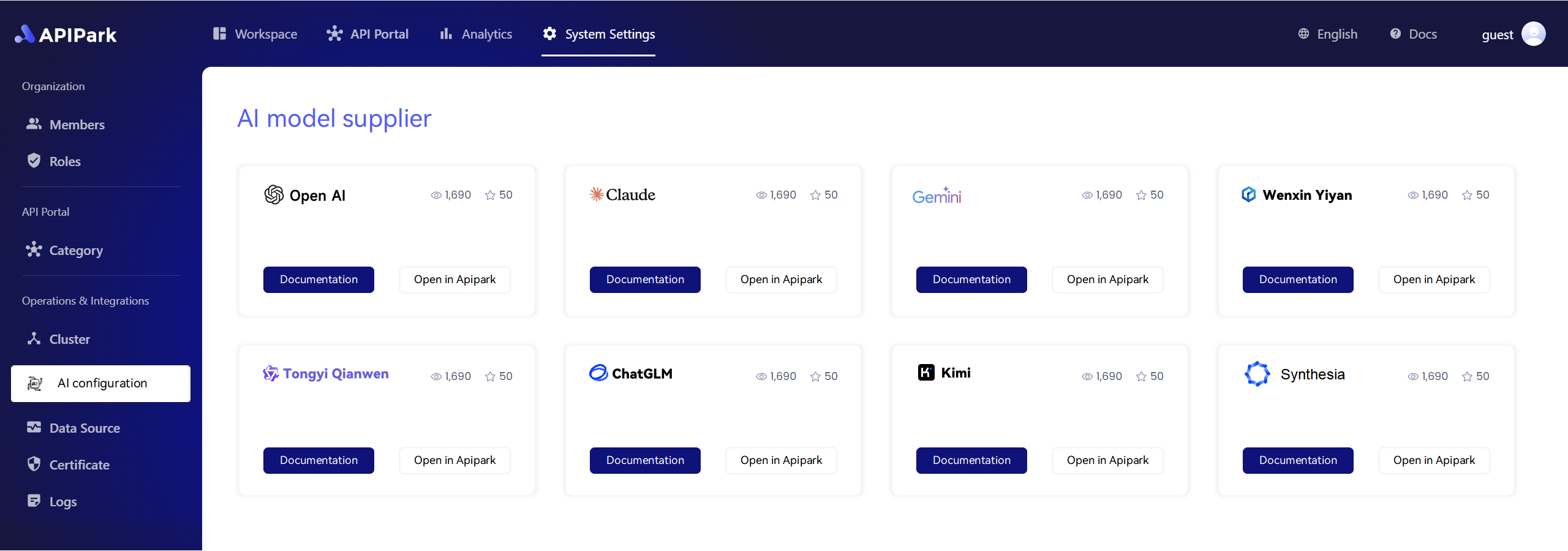

APIPark is a high-performance AI gateway that allows you to securely access the most comprehensive LLM APIs globally on the APIPark platform, including OpenAI, Anthropic, Mistral, Llama2, Google Gemini, and more.Try APIPark now! 👇👇👇

Conclusion

In summary, Crum and Forster stands as a pillar in the insurance industry, continuously innovating to offer bespoke solutions tailored to meet the unique needs of their clientele. By embracing advanced technologies such as AI and adhering to robust API Lifecycle Management, they are setting a standard for streamlined operations in the insurance ecosystem. Through these innovations, businesses can safeguard themselves more effectively against evolving risks, ensuring stability and security.

Investing in such technologies is no longer optional but essential for effective risk management and operational efficiency in a world where insurance needs are ever-changing. As organizations like Crum and Forster continue to pioneer this integration, they solidify their leading position in the market and open doors for enhanced enterprise security and service excellence.

🚀You can securely and efficiently call the Claude API on APIPark in just two steps:

Step 1: Deploy the APIPark AI gateway in 5 minutes.

APIPark is developed based on Golang, offering strong product performance and low development and maintenance costs. You can deploy APIPark with a single command line.

curl -sSO https://download.apipark.com/install/quick-start.sh; bash quick-start.sh

In my experience, you can see the successful deployment interface within 5 to 10 minutes. Then, you can log in to APIPark using your account.

Step 2: Call the Claude API.